[ad_1]

On the afternoon of December 5, 2022, the Ministry of Agriculture and Rural Development released Deputy Minister Phung Duc Tien’s Official Letter No. 8187/BNN-TCLN to the Ministry of Finance on Eliminating Difficulties in VAT Refund for Industrial Enterprises Exporting Timber and Forest Products…

The official statement said that in recent years, timber harvested from domestic plantations has been the main and most important source of supply, meeting about 75% of demand for raw materials and supporting Vietnam’s timber processing and export industries. The south continues to grow.

In 2021, the export value of this commodity group will reach US$16.3 billion, up 19.8% from 2020. In doing so, it has helped improve the living standards and incomes of poor people living in the region. places with difficult conditions and at the same time contribute to socio-economic development.

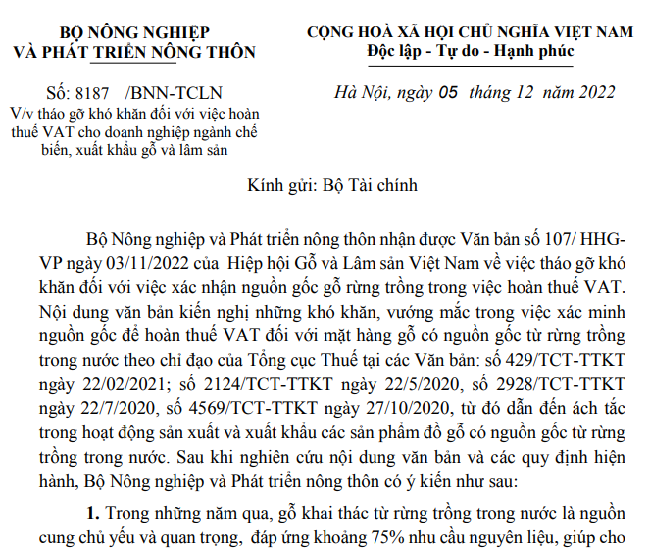

However, the Ministry of Agriculture and Rural Development received Document No. 107/HHG dated November 3, 2022 from the Vietnam Timber and Forest Products Association on Eliminating Difficulties in Certifying the Origin of Planted Forest Timber in VAT Refund.

“Timber sourced from scattered trees, gardens and forests planted in the country has a guaranteed legal origin. People decide on the use, create their own lists of forest products, are freely circulable and do not have to certify it. on the origin of state administrative bodies “.

According to Official Letter No. 8187/BNN-TCLN

Contents of the document recommending difficulties and obstacles in verifying the origin for the VAT refund for timber products from domestically planted forests under the direction of the General Department of Taxation in documents: No. 429/ TCT-TTKT dated 02/22/2021; No.2124/TCT-TTKT on May 22, 2020, No.2928/TCT-TTKT on July 22, 2020, No.4569/TCT-TTKT on October 27, 2020, resulting in bottleneck in production activities and timber export Products from native planted forests.

After examining the content of the document and the regulations in force, the Ministry of Agriculture and Rural Development declared that, in accordance with the provisions of Articles 15, 16 and 20 of Circular No. 27/2018/TT-BNNPTNT of November 16, the 2018 regulations were complied with The Department of Agriculture and Rural Development’s policy on the management and traceability of forest products means that wood from isolated trees, gardens and native forests is guaranteed to be of legal origin. People decide on exploitation, make their own lists of forest products, circulate freely, and do not have to confirm the origin of state administrative agencies.

Since then, the Ministry of Agriculture and Rural Development reiterated, “The verification of the origin of domestically harvested timber by the method of inspection and verification by the municipal-level People’s Committee and the relevant departments of the tax bureau is not appropriate.”

In addition, according to document No. 2124/CT-TTKT of May 22, 2020 of the General Tax Department on the identification of companies and industries threatened by VAT refunds, the assessment being made only on the basis of companies producing and trading plywood.

Currently, however, companies that process and export wood products for indoor and outdoor use, wood chips and pellets are particularly vulnerable to VAT refunds.

Therefore, the Department of Agriculture and Rural Development recommends that tax authorities make more thorough assessments when classifying and applying risks to wood products, especially for processors.

Pursuant to the provisions of Section 2, Article 73, Article 75 of the Tax Administration Act, 2019: Tax refund dossiers belonging to the high tax risk category according to the Risk Management Classification in Tax Administration are dossiers subject to pre-tax refund inspection. ; The deadline for processing tax refund dossiers is 40 days from the date the tax administration issues a written notification of acceptance of the dossiers, the tax administration has to decide whether to refund a tax refund or not to the taxpayer who is not entitled to a tax refund.

“Therefore, the fact that the tax authorities verify the wood origin of forest owners, who are households and individuals, and process VAT refunds for many months has caused difficulties for companies in the processing and exporting industries,” the official letter reads.

In order to alleviate difficulties and create favorable conditions for business, especially in the context of the ongoing impact of the Covid-19 epidemic, the difficult economic situation in the country and in the world, the Ministry of Agriculture and Rural Development has asked the village of the Ministry of Finance to consider and direct agencies to help businesses implement VAT-related policies.

[ad_2]

Source link