[ad_1]

HSBC has released a new report providing analysis and commentary on the Vietnamese economy, with a particular focus on export market risks.

Asian exporters have benefited greatly from increased demand for some products over the past two years, according to HBSC. In the context of many supply chain disruptions, Vietnam is still generally doing better and continues to increase its exports since the US-China trade tensions. This growth momentum sustained into the first six months of 2022, but signs now suggest that it is time for Vietnam’s import and export industry to prepare for a rough road ahead.

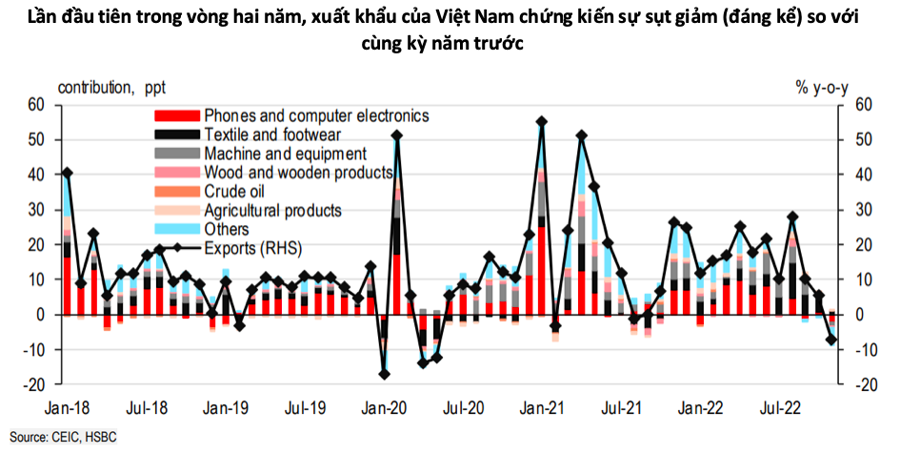

November data is notable including exports which fell 7.4% yoy, falling more than HSBC and the market forecast. This is the first time in two years that Vietnam has seen a significant yoy decline in export growth, mainly due to a slowdown across all sectors.

Meanwhile, as a rising star and deeply embedded in the global manufacturing ecosystem, Vietnam is not immune to the impact of this significant slowdown in world trade, in other words, the time to “stop” has come.

Notably, the PMI has steadily declined since May last year and has entered deep into the manufacturing contraction zone since September with a drop in the number of new orders. Vietnam falls in the “standing in front of the pole” category in terms of magnitude of impact. Since September, more than 630,000 workers have been affected by a drop in overseas orders, with about 90% having to reduce their working hours.

The main reason obviously lies in the electronics sector, which accounts for about 35% of Vietnam’s total export turnover. Since the second half of 2022, new orders for electronics have been falling sharply worldwide, affecting the consumer electronics industry more than industrial products. The impact is widespread in the three main destinations of Vietnamese exports: the US, mainland China and Europe. However, other export sectors of Vietnam tend to be affected by the economic downturn, particularly in the US.

Since the US-China trade war, Vietnam has gained a large share of the US market, reflected not only in traditional export sectors to the US such as electronics and textiles/leather, footwear, but also expanding into new areas such as machinery and wood products.

For example, Vietnam’s share of machinery exports has doubled to 13% of total exports in the last four years, mainly due to Vietnam’s growing participation in the technology sector, mainly due to Vietnam’s machinery exports related to electronic goods. At the same time, the US market also dominates, with a market share that has more than tripled in less than 10 years.

Vietnam has also benefited from the booming US real estate market, which has led to an increasing demand for wooden furniture. As a result, the US has consolidated its dominant position in timber products exported from Vietnam, which currently accounts for 60% of the market share. However, the real estate business in the US is beginning to slow down in the face of rising mortgage rates, and a similar trend can be seen in the European real estate market. This situation has led to a significant drop in Vietnamese exports of wood products.

Finally, Vietnam’s traditional exports, textiles and shoes, also begin to decline. While these two sectors continued to broadly support export growth in the third quarter, this was mainly due to the now absent low base effect. Against the background of high inflation and a shift in consumption from goods to services in western countries (services share currently around 60%), HSBC forecasts that Vietnam will still see a decline in this sector.

[ad_2]

Source link