[ad_1]

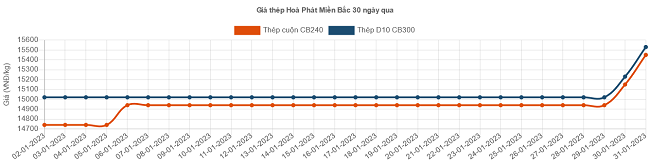

With this adjustment, North Hoa Phat steel brand increased by VND300/kg for CB240 coil and D10 CB300 rebar. The prices of these two products are currently VND 15,540/kg and VND 15,530/kg, respectively.

In Central region, CB240 steel coil increased by VND300/kg to current VND15,370/kg; Rebar D10 CB300 increased by 200 VND/kg, priced at 15,420 VND/kg.

In the south, Coil CB240 and Rebar D10 CB300 recorded an increase of VND300/kg. Currently, the prices for these two products are VND 15,420/kg and VND 15,470/kg, respectively.

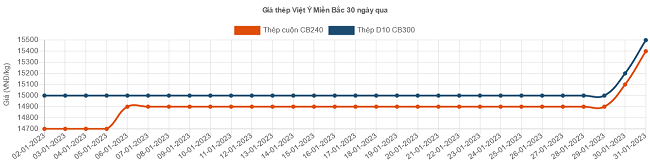

Similarly, steel brand Vietnam Italy increased by 300 VND/kg for both CB240 coil and D10 CB300 rebar. Currently, the price of these two products is VND 15,400/kg and VND 15,550/kg, respectively.

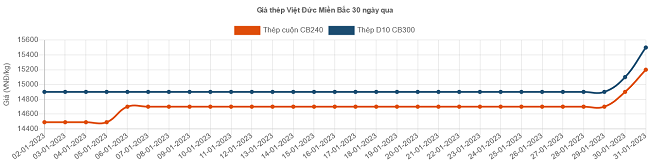

Viet Duc Steel in the North, increased by 300 VND/kg with CB240 coil, currently at 15,200 VND/kg; while rebar D10 CB300 increased by 400 VND/kg to 15,500 VND/kg.

In the central region, Viet Duc with CB240 steel spool increased by 300 VND/kg to 15,550 VND/kg; D10 CB300 rebar increased by VND 310/kg to VND 15,760/kg.

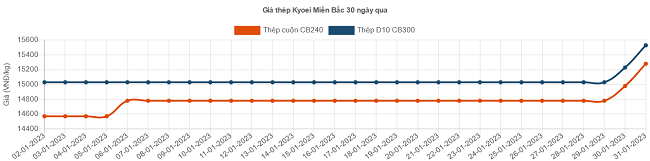

Adjusted Kyoei steel by 300 VND/kg for CB240 coil and D10-CB300 rebar. Currently, the prices of these two products are VND 15,280/kg and VND 15,530/kg.

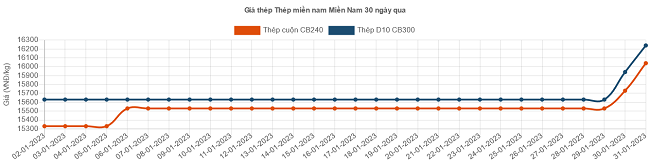

Southern steel increased by 310 VND/kg for CB240 coil and 300 VND/kg for D10 CB300 rebar. The price of these two products is currently VND 16.40/kg and VND 16,240/kg, respectively.

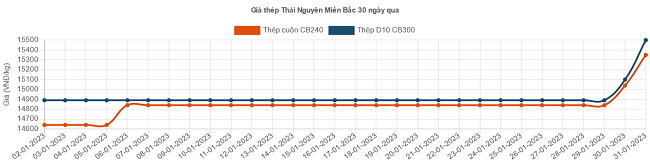

Thai Nguyen Steel, increased by 310 VND/kg for CB240 coil to 15,350 VND/kg; with reinforcement bar D10 CB300 increased by 400 VND/kg, currently priced at 15,500 VND/kg.

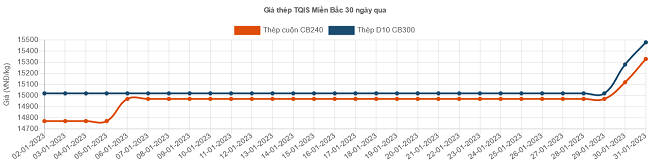

Tuyen Quang Iron and Steel Company Limited (TQIS), with CB240 steel coil increased by VND 210/kg to VND 15,350/kg; CB300 rebar has been increased by VND 200/kg and is currently at VND 15,480/kg.

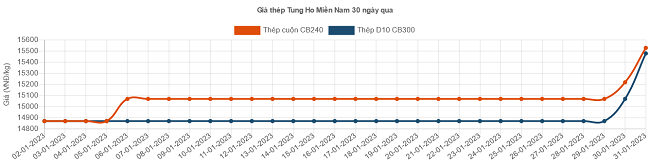

Steel brand Tung Ho in the south, increase by 310 VND/kg for CB240 coil to 15,530 VND/kg; with Rebar D10 CB300 increased by 410 VND/kg, current price at 15,480 VND/kg.

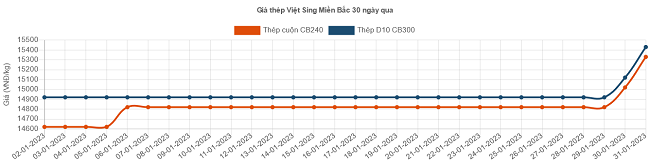

Viet Sing Steel, an increase of 310 VND/kg for both CB240 coil and D10 CB300 rebar. Currently, the price of these two products is VND 15,330/kg and VND 15,430/kg, respectively.

With the Vietnamese-American steel brand in the north, the price of CB240 coil steel increased by VND310/kg to VND15,380/kg.

In the central region, Vietnam increased by 300 VND/kg for CB240 spool to 15,680 VND/kg; with D10 CB300 rebar an increase of 510 VND/kg, currently at 15,580 VND/kg.

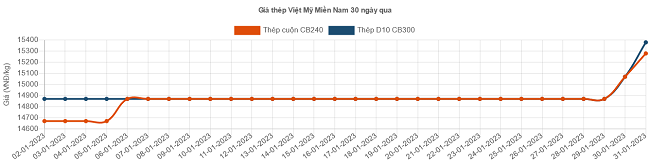

Similarly, South Vietnam also increased by 210 VND/kg for CB240 coil and 310 VND/kg for D10 CB300 rebar. The prices of these two products are currently VND 15,280/kg and VND 15,380/kg, respectively.

Although the domestic price of steel has been continuously adjusted by companies, this is not a result of market demand, but the main reason is the high price of raw materials for steel production.

In the Vietnam Steel Association (VSA) recent report on the situation of Vietnam steel market in December 2022 and 2022, the iron ore price traded at 116.95-117.45 USD/ton CFR Tianjin Port, China on January 6, 2023 . an increase of about $6.5/ton compared to early December 2022.

Similarly, the export price of coking coal at the Australian port was trading at approximately $282.5/tonne FOB on January 6, 2023, a sharp increase of $52.25/tonne compared to early December 2022.

The domestic steel scrap price increased by 500-700 dong/kg in December 2022 and remained at 8,900 dong-9,400 dong/kg. The price of imported scrap increased by USD 50/ton and remained at USD 400/ton until the end of December 2022. At the beginning of January 2023, steel scrap prices tended to increase. Steel scrap price traded at around USD 402-405/ton on January 6, 2022 in Dong A port.

The price of hot rolled coil (HRC) was 596 USD/ton CFR Dong A Port on January 6, 2023, increasing by 25 USD/ton compared to the transaction price in early December 2022. In general, the world market for hot rolled steel (HRC ), which makes the domestic HRC market difficult because flat steel producers (CRC, galvanized steel, steel pipes…) use HRC as raw materials for production.

Also, the Graphite Electrode Carbon market is expected to witness volatile long-term growth trends while inflation and supply chain concerns are likely to persist into 2023.

As for the situation of steel production and steel consumption in 2022, the VSA report did not provide very positive numbers either. Notably, finished steel production reached 29.339 million tons in 2022, down 11.9% from the same period in 2021. Finished steel consumption reached 27.3 million tons, down 7.2% from the same period in 2021. Of these, exports reached 6.28 million tons, down 19.1% from the same period last year.

In evaluating the steel market in 2022, VSA believes that it will be a challenging year when the domestic consumption market declines, the price of steel materials is complicated, and many steel companies face difficult situations, hardship and loss. “The domestic steel industry will continue to face many difficulties and challenges, which are expected to last until the second quarter of 2023,” VSA said.

Analyzing the prospects for the steel industry in 2023, some securities companies also stated that steel companies will continue to face a number of difficulties when construction demand falls, prices for the input materials for production increase… The expectation of the steel industry in 2023 is so public Investment disbursement is planned to increase by 20-25% compared to 2022.

On the export side, the industry supports that steel prices may be less volatile as demand in the Chinese market is stable after opening up with many measures to support and recover the real estate market. In general, the steel industry will remain difficult in the first half of 2023.

[ad_2]

Source link