[ad_1]

In the proposal to draft a revised special consumption tax bill that has just been submitted to the government by the Ministry of Finance, one of the notable elements is the proposal to expand the tax base by adding special consumption taxes to a range of items such as: sugary drinks, barley drinks and soft drinks Beverages…

This isn’t the first time the Treasury Department has wanted to impose a special excise duty on these items. Previously, this proposal was also made with a specific tax rate of 10%, but this was rejected by many ministries and sectors.

SEVERAL “LOOK” DIFFERENCES

As mentioned above, the consumption of sugary drinks and soft drinks is increasing in Vietnam, especially among young people. In 2021, the production of soft drinks in Vietnam will reach about 9 billion liters per year, with 85% of the annual production and consumption of the beverage market will be mainly soft drinks, instant tea, water and fruit juices of all kinds, energy drinks…

The beverage industry in Vietnam also attracts many investors, with the participation of a number of large domestic and foreign companies such as Tan Hiep Phat Group, Red Bull Co., Ltd., Coca-Cola Vietnam. …

According to statistics from the Vietnam Beer – Alcohol – Beverage Association (VBA), the annual turnover of the industry reaches over VND 200,000 billion and contributes nearly VND 60,000 billion to the state budget annually.

However, according to the World Health Organization (WHO), sugary drinks are the main cause of overweight and obesity and one of the leading risk factors for non-communicable diseases such as cardiovascular disease, diabetes … are currently experiencing explosive growth in the last few decades. According to statistics, in the period 2002 – 2016, the adult obesity rate in Vietnam over the age of 18 in both genders increased sharply by 68%.

According to the Department of Health, there is recent evidence that the consumption of sugary drinks is associated with noncommunicable diseases, resulting in economic losses, medical cost burden and mortality.

Therefore, “reducing sugar-sweetened beverages may prevent mortality by contributing to lower rates of overweight, obesity, dysglycemia, hyperlipidemia, and hypertension, which are risk factors for mortality.” Studies widespread in low- and middle-income countries also show tremendous socio-economic losses caused by non-communicable diseases,” acknowledged the Ministry of Health.

Therefore, the WHO has officially recommended that the governments of the countries take many measures to encourage people to access healthy food through tax measures on sugary drinks to guide consumption. The countries have gradually expanded the topic of excise duty to include sugary drinks.

Explaining the collection of excise duty on this item, the Ministry of Finance also emphasized protecting people’s health from unprofitable products such as sugary drinks, barley drinks and soft drinks, as well as implementing the recommendations of WHO and public health protection organizations, and importing some goods and services , produce, trade and consume.

SUCCESSFUL DAMAGES, beverage industry NEED TIME TO RECOVER

However, at the suggestion of the Ministry of Finance, the VBA Association said that the beverage industry will still face many difficulties and challenges in 2023 due to the consequences of the Covid 19 pandemic, which will have to be overcome over many years. In addition, there is the strategic competition and the conflict between Russia and Ukraine, which leads to difficulties in the supply of raw materials for production.

According to the VBA, the prices of input materials for production for all imported products from raw materials to packaging and packaging products rose sharply due to the need to import raw materials for beer production from Europe.

“Vietnamese beverage companies are also affected by a series of policies limiting alcoholic beverages, consumer spending power is falling due to economic difficulties post-Covid-19 pandemic, beverage status is unknown. Uncontrolled origin and informality tend to increase, it is difficult for formal and real companies to do business…”, the VBA association noted the difficulty.

Therefore, the companies belonging to the VBA association all want to stabilize the tax policy, especially the consumption tax, and propose to postpone the additional tax period of 1 to 1.5 years.

At the same time, VBA hopes that the state will continue to pay attention and support to industry enterprises to overcome difficulties and challenges, continue to make large contributions to the budget, restore the economy, create jobs and provide consumers with high quality, safe products for sustainable development…

Earlier, in 20218, the Ministry of Finance proposed to add the excise duty on sugary soft drinks to the taxable items except for dairy products.

However, many ministries and sectors believe that for a convincing basis of the proposal, it is necessary to research and concretely assess the impact on the health of consumers in Vietnam with the average output and consumption of soft drinks troops. Another view is that not only soft drinks but many sugary products need to be regulated?

The Ministry of Agriculture and Rural Development also suggested that there was a need to clearly define the term “sugar-sweetened beverages” in order to clearly determine to what extent sugar content should be included in this group in order to charge an appropriate excise duty.

Therefore, the papers suggest that the Treasury Department must examine and assess the impact of policies on the beverage industry, state budget revenues and other factors such as labor, employment and raw material supply. The main raw materials are tea and coffee , sugar cane…

HOW DO COUNTRIES PAY TAXES?

In fact, the goal of alcoholic beverages excise duty policy in Vietnam is quite similar to the basic goal in other countries around the world, where the most basic goal is still to protect the health of alcohol consumers and regulate the amount of usage.

According to statistics, only about 15 countries levied excise taxes on this item in 2012, but by 2021 this number will reach almost 50 countries. Within ASEAN, 6 out of 10 countries have excise taxes on sugary drinks.

For example, 6 countries including: Thailand, Philippines, Malaysia, Laos, Cambodia and Myanmar have imposed an excise tax on sugary beverages. Indonesia is currently considering levying an excise tax on sugary drinks.

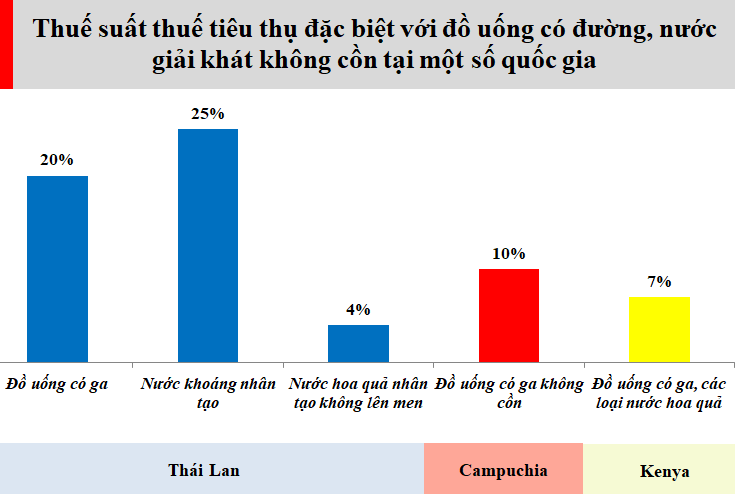

Specifically, Thailand levies an excise tax of 20% on carbonated beverages, 25% on artificial mineral water and 4% on non-fermented artificial fruit juices.

Indonesia is proposing to levy an excise tax on sugary and carbonated drinks ranging from 1,500 to 2,500 rupiah per liter, depending on the type of drink.

Cambodia imposes a 10% excise tax on non-alcoholic carbonated beverages and the like; The Philippines imposes an excise tax: 6 pesos per liter for beverages containing noncaloric sweeteners and noncaloric sweeteners or a blend of noncaloric and noncaloric sweeteners; 12 pesos/liter for beverages containing high fructose corn syrup or combined with a no-caloric or zero-calorie sweetener.

Some other countries such as B. Kenya imposes a 7% excise tax on carbonated drinks and fruit juices. France levies an excise duty on carbonated beverages of 0.0716 euros/litre. UK charges £0.23/litre for drinks with more than 8g/100ml sugar…

For barley and soft drinks, the Ministry of Finance found that imports of soft drinks were made using the same production process and production materials as sugar, separated from the product and natural flavors added.

Because the product does not contain alcohol, it is not identified as beer under the provisions of the Law on the Prevention of Harmful Effects of Alcohol; the product complies with TCVN 12828:2019 for soft drinks, therefore the company publishes the name and the product standard. The product is a barley drink and is therefore not subject to excise duty under the applicable law on special excise duty,” the Ministry of Finance said.

Currently, a number of countries such as Thailand and India are looking into imposing a special excise tax on 0-alcohol beer in the 14-22% range. In Oman, non-alcohol beer will be subject to a 50% excise tax from October 1, 2020 after the country implemented policies to extend the subject of the excise tax to beverage products, malt and non-alcoholic beer.

[ad_2]

Source link