[ad_1]

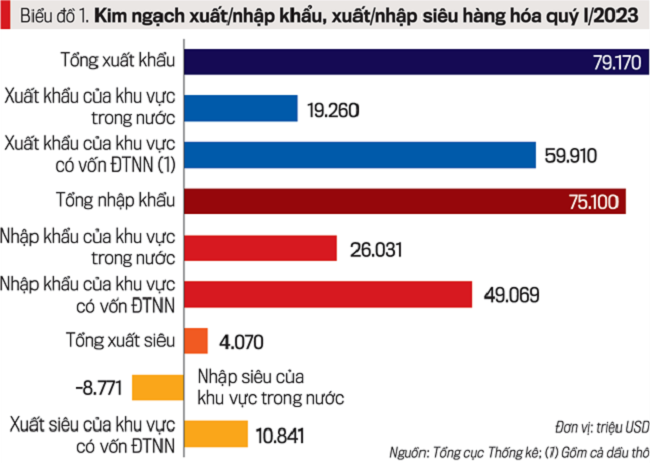

The most obvious finding is that Vietnam remains in a surplus position in trade relations with foreign countries. Compared to the same period last year, the trade surplus for the first quarter of this year was higher than the same period last year, both in terms of absolute size ($4,070 million compared to $1,822 million) and in terms of the trade surplus rate (5.1% compared to 0.2% in the same period last year).

SOME POSITIVE RESULTS

If the trade surplus continues to be maintained in the remaining months, 2023 will be the 8th consecutive year with a trade surplus (Chart 2).

The foreign investment (foreign investment) sector continues to show a large trade surplus. Compared to the same period, the trade surplus of this region in the first quarter of 2023 was both in absolute terms ($10,841 million compared to $8,566 million) and in terms of trade surplus (18.1% compared to 12%).

In the first 2 months of 2023, there were 54/86 large trade surplus markets, 5 of which had a trade surplus of over USD 500 million (US USD 11,156 million, Netherlands USD 1,387 million, UK USD 829 million, Germany USD 738 million). USD, Hong Kong USD 711 million).

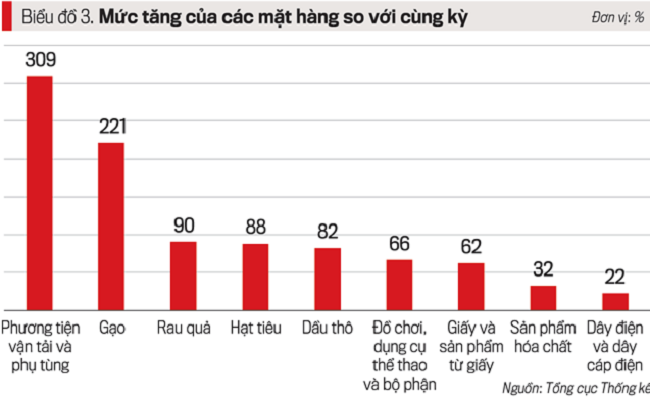

The trade surplus is achieved because exports are larger than imports in absolute terms. In export items, there were 9 major products that increased compared to the same period last year, with sales increasing as follows.

There are a number of key commodities that increase export volume (cashews, pepper, rice, cassava and cassava products, crude oil, plastic materials) and some key commodities that increase export prices (rice, ore) and other minerals, clinker and cement, coal, crude oil, petroleum).

In the first two months of this year, out of 86 main markets, there were 32 growing markets including Thailand.

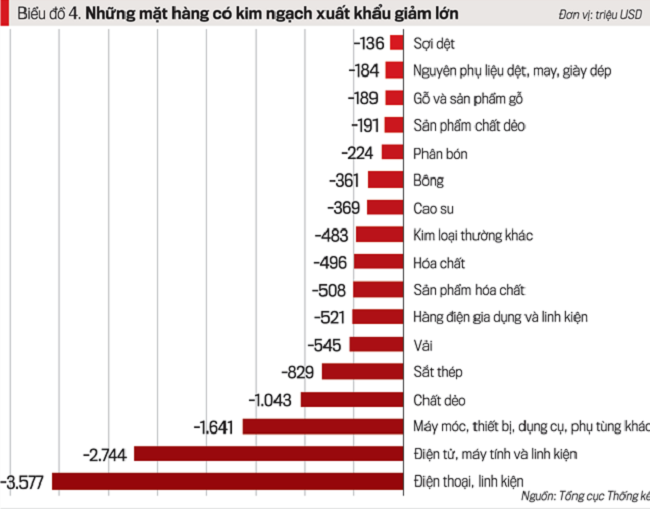

Imports continued to decline as 35/53 items had a decrease in sales compared to the same period last year, including 16 items with a large decrease (over $100 million), especially 3 items with a large decrease (over $1 billion). ). : phones, accessories; Computers, electronic products, components; Machines, devices, tools and spare parts.

According to the General Department of Customs, 60/86 markets saw import sales fall in the first two months of the year; 11 markets saw a big drop (over $100 million), the biggest drop was China ($4,604 million), the second was South Korea ($2,468 million), the third was Germany ($450 million). and the lowest decline in these 11 markets is Argentina at $111 million.

The trade surplus had a positive impact on a number of aspects: contributing to the elimination of the current account deficit (the trade deficit in the first quarter of this year was USD 216 million), improving the overall balance of payments, stabilizing foreign exchange reserves. Exchange rate, which contributes to the psychological effect and controls inflation according to the target (the average CPI in the first quarter of this year increased by 4.18% over the same period); curb the increase (even the decrease relative to GDP) in public debt, public debt and external debt; limit the decline, even contribute to economic growth in terms of an increase in aggregate demand according to the formula:

SUPER BIG ACHIEVEMENT BUT POTENTIAL ANNOUNCEMENT

Export sales compared to the same period last year 2-month declined 10%, the 3-month declined 11.9%, a larger decline than the 2-month decline rate.

The year-on-year decline occurred in both regions. The domestic sector declined further than the FDI sector (-17.4% compared to -10%), making the export share of the domestic sector lower than the same period last year (24.3% compared to the same period last year) . 26%), while the share of the FDI sector is correspondingly higher (75.7% vs. 74%), making the domestic economic sector already weak compared to the FDI sector. Foreign investment, now even weaker.

The decline compared to the same period of the previous year occurred in many key positions. Out of 45 main products, 22 items of export sales declined, of which 17 items recorded a sharp decline (over USD 100 million).

Data from the General Bureau of Statistics shows that the volume of a number of important export commodities has been reduced, such as E.g.: clinker and cement by 25%; Textile fibers down 19%; Gasoline and Oil Down 12.8%; Tea fell 5.9%; gum bottom 2.6%; iron and steel up 1.9% and coffee up 1.6%.

The content of the article was published in Vietnam Economic Review No. 14-2023, issued on April 3, 2023. Welcome readers to read The:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-king-te-viet-nam

[ad_2]

Source link