[ad_1]

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), the global market is still severely affected by inflation and economic slowdown, leading to a drop in demand for seafood, resulting in Vietnam’s seafood export volumes and prices in the first quarter as well decreased this year.

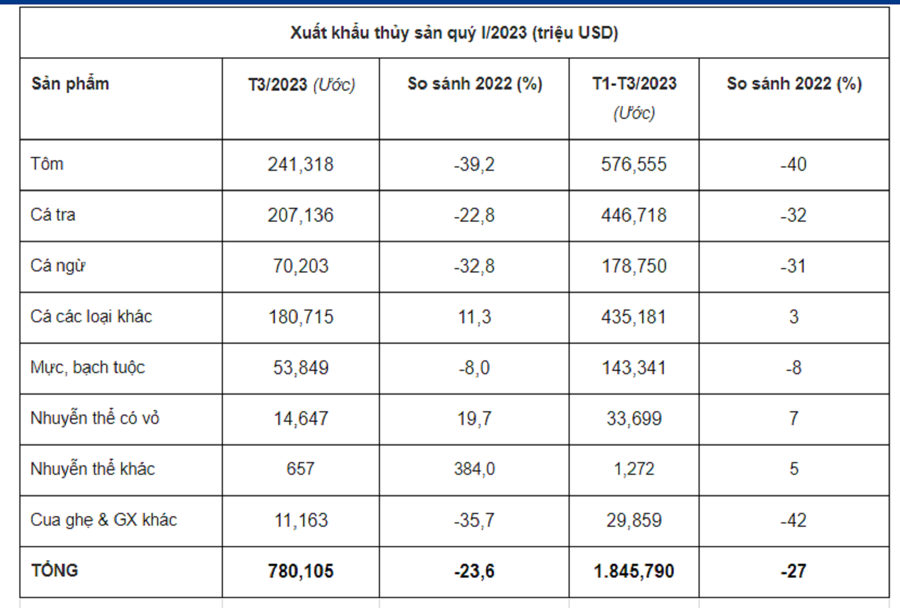

Notably, exports of most major seafood products fell from 8% to 39%. Exports of shrimp fell by 39%, pangasius by 23%, tuna by 33% and squid and squid by 8%. However, exports of other marine fish species still increased by 11% year-on-year.

SHRIMP EXPORT 40% OFF, Pangasius 32% OFF

By the end of the first quarter, shrimp exports brought in $577 million, down 40%; Pangasius export earned $447 million, down 32% from the same period; and tuna exports fell 31% to just $179 million.

Meanwhile, export sales of squid and octopus were also down 8% from the same period last year, reaching only US$54 million. In particular, the export of marine fish species increased slightly by 3% to USD 435 million.

Although inflation has cooled, gasoline prices have fallen, but the cost of production and prices of practical products in the United States are still high, so people still need to limit spending during this period and tend to consume more products at lower prices .

As a result, the average price of US seafood imports fell more than 9% from the same period last year. By the end of March, Vietnam’s seafood exports to the United States totaled $237 million, down 55% from the same period last year. Shrimp alone made up 37%, tuna 23%, pangasius 17% and other sea fish products 15%.

“In the context of inflation, U.S. seafood import and consumption increases proportionately in the frozen segment and decreases more sharply in the value-added processed goods segment, so it will be difficult to break through in the coming months,” VASEP said .

“Seafood exports to the US have trended downward since the last quarter of 2022 and continued to fall sharply in the first three months of this year. So far, the US accounts for only 14.5% of total Vietnamese seafood exports, but still holds the No. 1 entry-level market position.”

According to VASEP.

In addition to the US market, China is considered a driving force in the scenario of Vietnam’s seafood exports in 2023 after the country completely lifted the zero-Covid policy. However, China is like a big piece of cake shared by many exporting countries and creates too much competitive pressure.

Vietnam has two main competitors, Ecuador and India, which hold a dominant market share with more than 60% of Chinese shrimp imports. The strength of these two countries is frozen shrimp products, small size, cheap price.

Not only shrimp, but also for other sea products such as sea fish, squid, octopus… Vietnam is also in competition with seafood exporters and traders from other countries.

In the first quarter of this year, seafood exports to China and Hong Kong totaled nearly $230 million, down 9% year-on-year (mainly due to a drop in January). Seafood exports to this market in February and March showed good signals with increases of 25% and 30% respectively.

In addition to key products and starches such as pangasius, Vietnamese seafood companies can utilize fresh/live seafood starches that are exported to the Chinese market for the restaurant and hotel segments. , tourism. For example: black tiger shrimp, lobster, sea fish, crab, oysters, scallops…fresh/raw.

“Furthermore, it is possible to enter and exploit the Chinese market from a local perspective. There are places in China with characteristics and consumption habits similar to Vietnam, which prefer Vietnamese seafood products more. For example, Guangxi imports more than 75% of seafood from Vietnam, only 25% from other countries,” said Ms. Le Hang, communications director of VASEP.

RECOVERY FROM Q2

Regarding the market trends of some major seafood products in the first half of 2023, Ms. Le Hang said that seafood exports are likely to gradually recover from the second quarter after international trade fairs held in the US and EU to attract more customers to Vietnam beckon .

A highlight of the March 2023 Fish Market was a standout event, the North American International Seafood Fair, held on March 12-14, 2023 with the participation of hundreds of companies around the world, including 17 leading companies from around Vietnam.

This year, the number of companies participating in this fair increased sharply, especially in the Asia and Pacific region. Many traditional partners and new importers came to the fair with a desire to find new Vietnamese products. Therefore, this year’s North American Fair boosts Vietnam’s fish trade with the US and other importing countries to recover from the first quarter.

VASEP predicts that shrimp products will slowly recover due to stiff competition from India, Ecuador and Indonesia. Pangasius will do better in the context of inflation and economic slowdown in many markets and there will be more great opportunities after China fully reopens post Covid-19. Marine fish species continue to increase, including a growing contribution from processed goods exported from imported materials such as salmon, cod and pollock.

In major markets such as EU and United States, there is a tendency to increase the consumption of traditional products for Asian consumers and the export of dry goods (fish, shrimp, squid), fish sauce, fish cakes, canned food, etc. etc. to increase.

“China is becoming the largest import market, but the competitive pressure is also increasing because the countries are also focusing on this market after opening up. Exports to the EU, US, Japan and South Korea markets are difficult to break through as inflation restrains consumers from spending and the average import price falls year-on-year.

Ms. Le Hang, Communications Director of VASEP.

Based on the reality of market fluctuations, Ms. Le Hang recommends that companies must make reasonable adjustments to export products. In addition to frozen products, companies in China have taken advantage of geographic proximity to increase exports of shrimp and fresh seafood to the catering, hotel and tourism industries.

With other big markets like US and EU, companies are more interested in the trend of importing goods for Asian supermarkets, and traditional Asian product lines like: dry goods, fish sauce, fish sauce… still attract customers.

“Faced with a difficult market in 2023, enterprises look forward to management agencies helping solve the immediate difficulties and inadequacies for enterprises, stabilize raw material sources and promote exports, especially government policies and the implementation of preferential tariffs for.” Farmers, fishermen and seafood processors,” stressed Ms. Le Hang.

Mr. Truong Dinh Hoe, secretary-general of VASEP, said that seafood processing and exporting companies must focus on high food safety products, pay attention to consumer trends and increase product value.

While competing countries like India and Ecuador focus on pre-processed products, Vietnam’s successes in recent years have been owed to companies focusing on high value-added products.

According to Mr. Hoe, the global consumption trend is focused on products that are good for health, are environmentally friendly and promote the circular economy. Therefore, the fishing industry must develop according to a green economic model and focus on sustainable agriculture, such as B. the model of rice shrimp, wild shrimp, etc. to create sustainable agricultural products to win customers worldwide. On the other hand, it is necessary to focus on processing new products from by-products in order to increase the competitiveness of Vietnamese seafood.

[ad_2]

Source link