[ad_1]

As reported by VnEconomy, the State Bank has just made an official decision to adjust the maximum interest rate on deposits with a term of 1 month to 6 months from 4% to 5% per year. This decision will come into effect on September 23, 2022.

On the first day that the above decision came into effect, a number of commercial banks in particular raised the new interest rates on short-term deposits with many listed maturities to the maximum permissible level.

In particular, the SCB deposit interest rate for short terms of less than 6 months, which has been applicable since September 23 for individual customers, has been increased significantly. Interest on demand deposits rose from 0.2%/year to the permissible upper limit of 0.5%/year. Similarly, the interest rate on 1-5 month term deposits, previously paid by SCB at 4%/year, has now also been reduced to 4.9%/year with a maturity of 1 month and capped at 5%/ year with a term of 2-5 months.

ACB is also one of the first banks to announce a new interest rate table on deposits, increasing the top interest rate for a term of 1 to 3 months to the maximum allowable interest rate of 5%/year, which is based on the “Tai Loc” package is applied. receive interest at the end of the term. Previously, the maximum interest rate applicable to these terms was 4%/year.

Likewise, as of September 23, SHB will apply a new rate schedule. Interest rates for maturities from 1 month to less than 6 months have increased by 0.8 – 0.9 percentage points compared to before. Accordingly, these interest rates range between 4.4 and 4.8%/year.

As a result, from September 23 to today, a number of banks have adjusted to increase savings rates for less than 6 months, including: Kienlongbank, Eximbank, Vietcapital Bank, BacABank, VPBank….

While private banks have simultaneously hiked interest rates, the group of state-owned commercial banks (Vietcombank, BIDV, VietinBank, Agribank) has yet to make any new announcements. Currently, the interest rate of this group is only 3.1-3.4%/year for short-term maturities of less than 6 months.

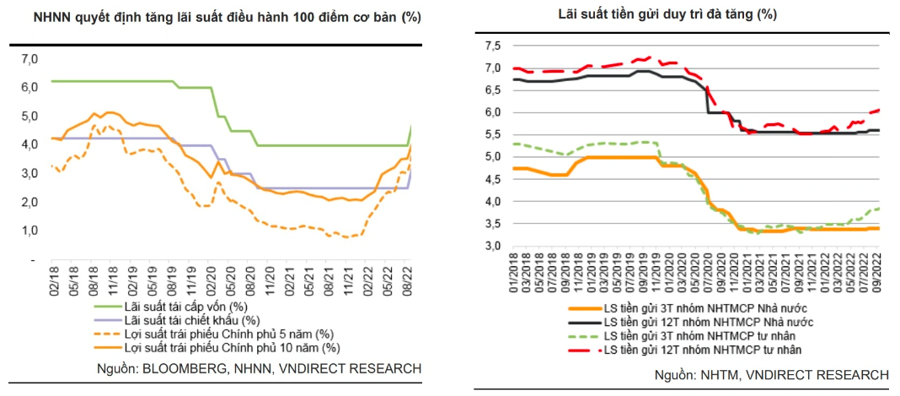

In the latest report, VNDirect Securities Company said that as of September 14, interest rates on 3-month and 12-month term deposits from private commercial banks increased by 0.44 percentage point and 0.51 percentage point, respectively, from the end of 2021 , deposit rates rose at the Landesbanken it was much slower with 0.03 percentage points and 0.07 percentage points respectively.

In connection with a sharp increase in operating interest rates by the State Bank of Vietnam, a readjusted credit space, slow growth in deposits in the first 7 months of the year … analysts from VNDirect predict that interest rates on deposits will continue to increase . in the last months of 2022.

“Deposit rates may increase by 0.3-0.5 percentage points from current levels in the final months of the year. Accordingly, the 12-month commercial bank deposit rate (on average) will rise to 6.1-6.3%/year by the end of 2022,” the research team predicts.

In 2023, VNDirect expects deposit interest rates to continue rising as the state bank raises the operating rate to control inflation and stabilize the exchange rate, while commercial banks need to increase mobilization demand for capital to fund lending activity amid strong economic activity Recreation.

The expected increase in deposit rates in 2023 is 0.5 percentage points, taking banks’ 12-month term deposit rates to 6.6-6.8%/year.

[ad_2]

Source link