[ad_1]

Citing Vietnamese customs statistics, the Vietnam Association of Seafood Exporters and Producers (VASEP) said Vietnam’s pangasius exports reached over US$1.8 billion in the first eight months of 2022, an 81% increase over the same period of the year Previous year equals last year. Among them, pangasius exports to the US market accounted for 23% with more than USD 421 million, an increase of 87% over the 8 months of 2021.

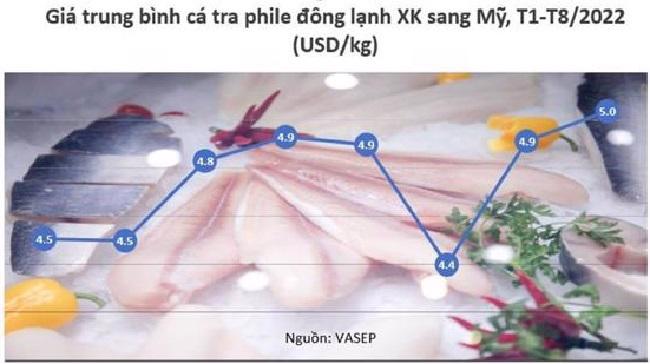

PRICE OF PANGASIUS EXPORTS TO US REDRECORD $5/KG

According to VASEP, in August 2022 alone, our country’s pangasius exports to the United States reached USD 33 million, up 45% from August 2021. Sales of pangasius to the US in August 2022 were only slightly higher than the nearly US$32 million in July 2022. However, the average price of frozen pangasius fillets exported to the US in August 2022 peaked at US$5/ kg – this is the highest price ever recorded.

In the first eight months of 2022, frozen pangasius fillets accounted for 87% of pangasius exports to the United States. It is estimated that Vietnam exported about 94,000 tons of frozen pangasius fillets to the United States during this period.

However, after reaching high levels from March to May with a volume of around 13.5 to 16,000 tons/month, pangasius exports to this market started to slow down from June, falling to the lowest level of the year and recovering in July slightly August 2022.

“US pangasius imports are set to increase in the coming months as food price inflation in general and seafood in particular shakes the US market while entering a cycle of rising demand for the upcoming Christmas and New Year.”

Ms. Le Hang, Deputy Director of VASEP Training and Trade Promotion Center (VASEP.PRO)

According to statistics from the US Department of Agriculture, the US imported a total of 95.4 thousand tons of frozen pangasius worth nearly $403 million in the first 7 months of 2022, an increase of 35% in volume and 106% in price over the same period of the previous year.

Meanwhile, imports of frozen pangasius from Vietnam to the US reached 88.2 thousand tons worth US$371 million, up 34% and 109% respectively from the same period last year. Vietnam accounted for over 92% of the volume and value of pangasius imported from the US in the first 7 months of the year.

In addition, the United States also imports pangasius from China, Taiwan, Thailand and Brazil. Of this, China accounts for around 5% and the other countries around 3%.

The average price for frozen pangasius imports to the United States reached $4.22/kg in the first 7 months of this year, up 53% from the same period last year. Notably, the import price of frozen pangasius in Vietnam increased by 56% to $4.21/kg.

Filets (HS code 030462) accounted for 96% of US frozen pangasius imports, at over 91,000 tonnes valued at US$385 million. Imports from Vietnam alone reached 86.6 thousand tons worth $364 million. In addition, the volume of pangasius whole/cut, HS code 030324, imported into the US accounted for only 1.3 thousand tons worth US$5.8 million.

According to VASEP, it’s possible that US pangasius imports will increase in the coming months as food price inflation in general and seafood in particular falter and also intervene in the US market. The demand cycle increases for the upcoming Christmas and New Year .

INCREASE IN AQUATIC PRICE, US PEOPLE INCREASED WASTE CONSUMPTION

According to updated data from data and technology company Numerator, overall commodity inflation in the US market hit a record in July and remained flat in August 2022.

In particular, overall commodity inflation hit a record high of 15.4% in July, pushing headline inflation up 26% in the first 7 months.

In particular, the average inflation rate for seafood products increased by 16.8% in July 2022, far exceeding the overall commodity inflation rate in the US market.

However, the price increase of shrimp was 8.5%, below the average inflation rate. Meanwhile, the highest price increase for fish products in the US market was pangasius.

“In the US market, the price increase of pangasius was more than 25% in July 2022 alone and the average selling price of this product is now up over 60% compared to this time last year.”

According to Numerator Data and Technology Company – USA.

Explaining the reason for the sharp increase in the price of pangasius in the US market, Numerator said that in connection with the high inflation, the US population has reduced the consumption of high-priced fish products and switched to low-priced fish products.

Compared to catfish farmed in the United States, imported pangasius is very cheap, only 1/4 – 1/5 the retail price of other catfish species.

According to Chris Dubois, senior managing director of Chicago-based Retail and Consumer Analytics (IRI), the fish market in the United States has reached an inflection point, with sales falling rapidly due to rising prices. The latest seafood consumption figures in the US market show that inflation is increasing and causing many difficulties for the consumer and retail industries.

Sales of fresh seafood in August 2022 fell by almost 10% year-on-year, while sales in USD fell by 5.2%. The average price per pound of fresh seafood was $9.29 per pound in August 2022, up 5.2% year-on-year.

Mr Chris DuBois said seafood is facing serious difficulties as sales continue to fall due to high prices. Prices rose 5.2%, but sales fell 5.2% and volume fell 9.8%. This result shows that the price increase has reached the breaking point for consumers.

With the price of catfish already out of reach for consumers in the United States, the United States Department of Agriculture (USDA) plans to purchase 1.44 million pounds of catfish products for its federal food aid program.

The program is designed to help feed seniors and people with disabilities who qualify for President Joe Biden’s Build Back Better program.

Specifically, the program aims to import cheap catfish products to compensate for expensive catfish products, where pangasius, priced well below catfish’s usual levels, has become a priority product selected by the USDA for import.

According to the USDA, the goal of the program is to transform the food system for the benefit of consumers, producers and rural communities by providing more choice, greater accessibility and new markets for small and medium-sized producers.

The program builds on lessons learned from the Covid-19 pandemic and the supply chain disruptions caused by the Russia-Ukraine conflict. The winning documents for this catfish import program will be announced at the end of September 2022, with delivery from November 1st to January 31st, 2023.

[ad_2]

Source link