[ad_1]

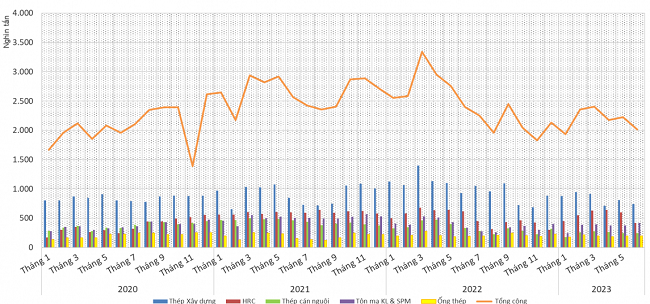

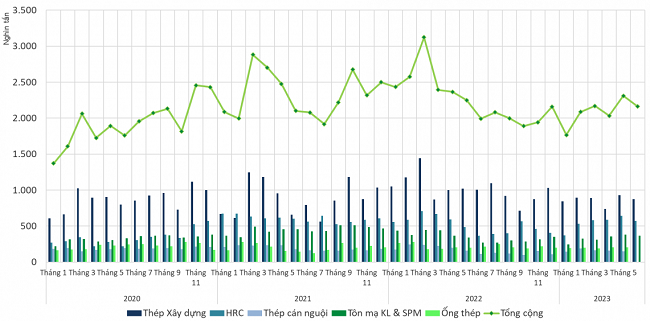

According to the latest report data from Vietnam Steel Association (VSA), the finished steel production reached 2.012 million tons in June 2023, down 9.52% compared to May 2023 and down 16.2% compared to the same period in the year corresponds to 2022. Steel consumption of all kinds reached 2,161 million tons, down 6.41% from the previous month and 4% down from the same period in 2022;

In general, finished steel production reached 13,103 million tons in the first 6 months of 2023, down 20.9% from the same period in 2022. Finished steel consumption reached 12,481 million tons, down 17.5% from the same period last year . 2022.

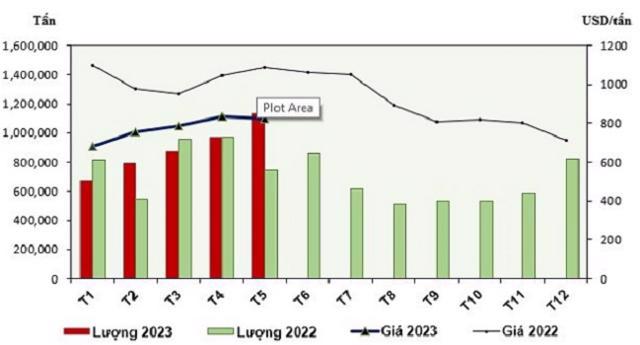

The export of steel products in May 2023 was about 1.133 million tons of steel, an increase of 16.43% compared with April 2023 and an increase of 52.6% compared with the same period last year. The export value reached more than US$931 million, up 14.53% month-on-month and up 15.2% over the same period in 2022.

In the first five months of 2023, Vietnam exported around 4.383 million tons of steel, 10.12% more than in the same period last year. The export value reached US$3.448 billion, down 16.21% from the same period in 2022.

Source: VSA.

The main export markets of Vietnam in the first 5 months of 2023 are: ASEAN region (34.76%), EU region (24.68%), United States (6.77%), India (4.7%) , 0.72%) and Brazil (3.36%). .

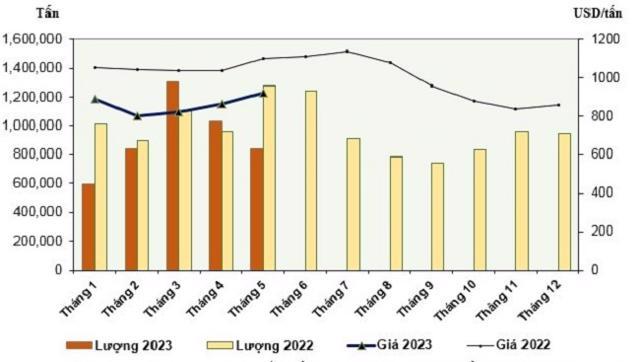

From the opposite direction, imports of all kinds of finished steel products to Vietnam in May 2023 reached more than 837,000 tons with a value of more than US$772 million, down 18.92% in volume and 13.54% in value, respectively compared to April corresponds to 2023; compared to the same period in 2022, they decreased in volume by 34.54% and in value by 45.01% in the same period in 2022.

In general, imports of all kinds of finished steel products to Vietnam in the first five months of 2023 were about 4.606 million tons, valued at more than $3.934 billion, down 12.33% in volume and 29.61% equivalent in value.

Source: VSA.

The top steel suppliers to Vietnam include: China (54.17%), Japan (16.01%), Korea (8.87%), India (6.74%) and Taiwan Loan (6.67%).

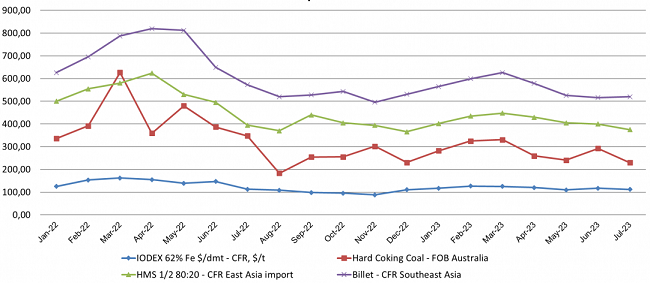

Regarding the market situation of steel production materials, the report by VSA showed that the iron ore price traded at 112 USD/ton CFR in Tianjin Port, China on July 6, 2023, a negligible increase of about 1% compared to the beginning of June 2023 is equivalent to. The average price of iron ore was about $113 per tonne in the second quarter of 2023, down 11% compared to the first quarter of 2023 and down 19% compared to the same period in 2022. The average iron ore price is $118.3/tonne, down 15% compared to the same period in 2022.

The price of coking coal for export in the Australian port was around USD 230/tonne FOB on July 6, 2023, which is the transaction price compared to early June 2023.

On average, the price of coking coal traded at $243.8/ton in Q2 2023, down 29% compared to the average price in Q1 2023 and down 45% compared to the same period in early 2022 In 2023, the average transaction price reached $293.6/ton, down 36.9% from the same period last year.

Steel scrap price traded at $375/ton at Dong A port on July 6, 2023, down 4% compared to early June 2023. For example, the average price of steel scrap traded in East Asian ports reached $421/ton in the first half of 2023, down 22.6% from the same period in 2022.

The price of hot-rolled coil (HRC) on 06/07/2023 was 571 USD/ton, CFR Vietnam, 35 USD/ton less than the first transaction price in June 2023. In general, the world market for hot-rolled steel (HRC) fluctuates, which reflects the domestic HRC market difficult as flat steel producers (CRC, galvanized steel, steel pipes…) use HRC as raw materials for production.

VSA cited slow demand as the reason for the decline in steel production and consumption. In addition, domestic steel companies must also compete with cheap Chinese steel as the country steadily lowers export steel prices. It is forecast that steel consumption will remain low from now until the end of the year and there may be further price reductions.

While domestic steel production has fallen sharply, imported steel is still entering Vietnam in large quantities. Specifically, over 4.6 million tons of steel products of all kinds were imported to Vietnam in the first 5 months of 2023, with steel from China alone accounting for 54.17% of the total steel imports.

The petition, addressed to the government, the Ministry of Industry and Trade and the Ministry of Science and Technology, explains why imported steel is still “massively” flowing into Vietnam. It is proposed to consider the construction of technical goods and inspection procedures. Regarding the quality of steel imported to Vietnam, VSA explained that the conditions for importing steel are currently very “loose” and steel products do not belong to Group 2, resulting in security risks according to Circular 06/2020/TT-BKHCN, and therefore no regulation require declaration of conformity, inspection of imported products and goods. At present, imported steel is mostly subject to 0% import tax, Green Channel goods should be exempted from the detailed examination of documents and goods.

Previously, according to the provisions of the Joint Circular No. 58/2015/TTLT-BCT-BKHCN, imported steel had to undergo two stages of inspection for customs clearance: Quality check at a designated inspection organization. . Thereafter, the company must take the inspection certificate to the Standards, Metrology and Quality Sub-Department of the Ministry of Science and Technology to receive a notification of satisfactory results. However, on September 21, 2017, the Ministry of Industry and Trade issued Circular 18/2017/TT-BCT abolishing the steel import procedure.

Therefore, the import of steel products to Vietnam is relaxed and there is no quality control process as before, leading to massive imports to Vietnam, especially products from China, which are increasing very rapidly.

VSA said countries around the world are ramping up technical barriers and trade measures to protect domestic manufacturing industries. There are clearly technical barriers in countries like Thailand, Indonesia, Malaysia, Korea, India, Australia, UK etc.

Accordingly, products exported to these countries require a certificate of compliance with the importing country’s quality standards for products that meet the importing country’s standards. The aim of these permits is to prevent the import of inferior products and to strengthen control over imported steel.

Meanwhile, Vietnam’s steel industry is suffering losses, but the amount of imported steel is still high, subject to 0% tax and not subject to trade measures.

Therefore, VSA recommends that the government, the Ministry of Industry and Trade and the Ministry of Science and Technology consider developing processes and procedures to verify the quality of steel imported into Vietnam.

Accordingly, imported steel must have a certificate of compliance with Vietnamese quality standards before import. At the same time, the investigation and application of appropriate trade defense measures will be strengthened to limit unfair competition in steel products and protect the domestic steel industry.

[ad_2]

Source link