[ad_1]

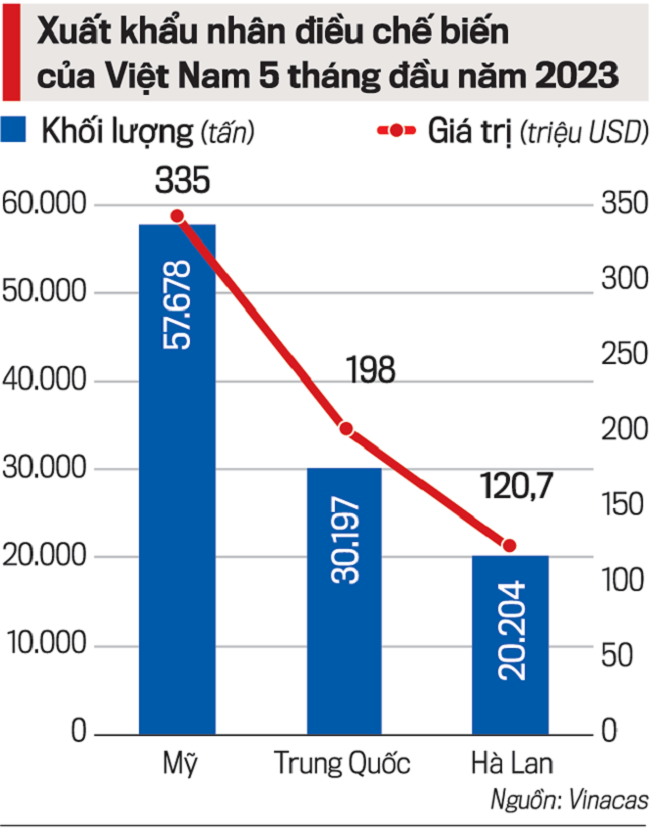

According to the Ministry of Agriculture and Rural Development, Vietnam exported 276,000 tons of cashew nuts in the first six months of 2023, accounting for sales of US$1.61 billion, increasing production by 10.5% or 7.7% of the value over the same period last year. However, the average export price of cashew nuts was $5,805/ton in the second quarter of 2023, down 2.3% compared to the first quarter of 2023 and down 5% compared to the same period last year.

Binh Phuoc Province is considered the “capital” of Vietnamese cashew cultivation, accounting for more than 50% of the country’s export processing and export volume. Ms. Tran Tuyet Minh, vice chairwoman of the Binh Phuoc Provincial People’s Committee, said that there are 1,416 cashew nut processing plants in the province, accounting for 27 to 45 percent of the province’s total export sales each year. In 2022, the total export value of Binh Phuoc cashew nut products will reach US$1.045 billion.

But behind the growth of cashew nut exports in the first half of 2023, few reckon with the situation in which cashew processing companies are on the brink of life and death. According to Binh Phuoc Provincial Ministry of Industry and Trade, many cashew companies in the province are being forced to close, cease operations and some companies are even running into large debts.

The paradox of the cashew industry: HIGH IMPORT, LOW SALES

For many months, Mr. Tran Quoc Hung’s company has been operating in moderation in Phuoc Long city. With the average company that used to process 100 tons of cashews a month reduced to just a fifth, the company has laid off more than half of its workers.

“Although there are still orders, the export price of processed cashews is currently lower than the cost of production. It is estimated that for every kilogram of cashews produced, companies lose VND 4,000 to 5,000. The price of raw materials is high, but the price of cashew nuts for processing is falling. At present, companies that sell products but can’t sell them because they can’t generate cash flow are also dying, losing more money on warehousing and warehousing,” Mr Hung said.

Mr. Bach Khanh Nhut, Vice President of the Vietnam Cashew Association (VINACAS), explained this paradox and said that Vietnam has been the world’s number one cashew nut exporter for many years and currently accounts for over 75% of the world cashew nut exports.

Many companies have actively invested in modern machinery and equipment to improve deep processing. As a result, besides traditional products such as salted roasted cashews, cashew nuts and salted roasted silk shells, many new products were born and well received by the market, such as: honey cashews, spiced cashews, wasabi cashews, dried white sesame cashews, cashew candies…

However, since the total processing capacity of the cashew industry is too large and is four times higher than domestic cashew production, it is necessary to import raw cashew nuts from African countries for processing.

“It is paradoxical that while Vietnam is the world’s largest exporter of cashews, in recent years the amount of cashews imported into Vietnam to go through a few more steps and then export has increased rapidly. “This is the result of allowing the import of cashew nuts into Vietnam without taking any measures to protect the domestic cashew processing industry,” Mr Bach Khanh Nhut said bitterly.

In recent years, countries that specialize in supplying raw cashews to Vietnam (such as Ivory Coast and Cambodia) have invested in processing for export to compete with Vietnam, while driving the selling prices of the raw materials to sky-high levels.

Fearing a shortage of raw materials, our country’s cashew processing plants have had periods of massive importation of raw materials despite high prices. Typically, Vietnamese cashew industry spends up to US$4.1 billion on importing raw materials in 2021, while processing exports in the same year are only US$3.6 billion, resulting in millions of tons of raw materials not being processed on time, the inventory is long-term and the quality is falling.

This situation will continue in 2022, the amount of imported raw cashew nuts is still larger than the total raw cashew production of the entire processing industry in one year, with the result that in the first half of 2023 most companies will no longer process from raw cashew to kernel as before, but will have to recycle their stocks. Because of this, the price of cashew nuts increases, but the product has to be exported at a lower price due to the lower quality.

CREATING VALUE WITH INNER MATERIALS

VINACAS said China has recently reduced its imports of cashews from Vietnam but has sharply increased imports from sources in Africa such as Ivory Coast, Togo, Tanzania and Benin. The EU also reduced cashew imports from Binh Phuoc (Vietnam), but increased imports from Ivory Coast.

According to Mr. Pham Van Cong, President of VINACAS, Vietnam’s cashew industry is currently facing tough competition as Cambodia, West African and East African countries with large land areas are also promoting the development of cashew trees and the processing and export of cashew nuts.

In the current difficult situation, many companies have found a way out through the “death door” by investing together again in building a domestic cashew growing area. Aware of the value of Binh Phuoc cashew nuts, Mr. Truong Van Thanh, director of Nhu Hoang Agricultural Service Trading Cooperative (Bu Dang District), said the cooperative has taken a new turn, namely Binh Phuoc’s original cashew nut business. This is a product that has been tested and recognized worldwide for the best quality and has its own characteristics. When customers use Binh Phuoc cashews, they prefer the product quality over cashews from other countries in the world.

In 2022, Vietnam’s cashews will reach 519,782 tons worth US$3.08 billion, down 10.3% in volume and 15.1% in value from 2021. In 2023, Vinacas aims to export $3.1 billion worth of cashews.

Mr. Vu Manh Tung, Director of Golden Cashew Company Limited (Bu Nho Township, Phu Rieng District, Binh Phuoc Province) said that the question is “difference or death” to survive in the currently tough cashew market. We had to take a new twist to bring Binh Phuoc cashew nuts to the big market. If we continue as we have been, we will forever be a shadow on the world cashew market. Therefore, the brand equity needs to be built in another way, which is through the raw cashew nut product in Binh Phuoc.

According to the Ministry of Agriculture and Rural Development of Binh Phuoc Province, there are more than 152,000 hectares of cashew nuts in the province with an annual production of 170,000 tons. However, cashew processors have long been indifferent to investment in commodity area development; have signed purchase agreements with cashew growers, which has resulted in cashew cultivation in the region producing very little and covering less than 30% of processing needs. Now is the time to put pressure on both sides, companies are interested in domestic raw materials…

The content of the article was published in Vietnam Economic Review No. 30-2023 on July 24, 2023. Readers are welcome to read it here:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-king-te-viet-nam

[ad_2]

Source link