[ad_1]

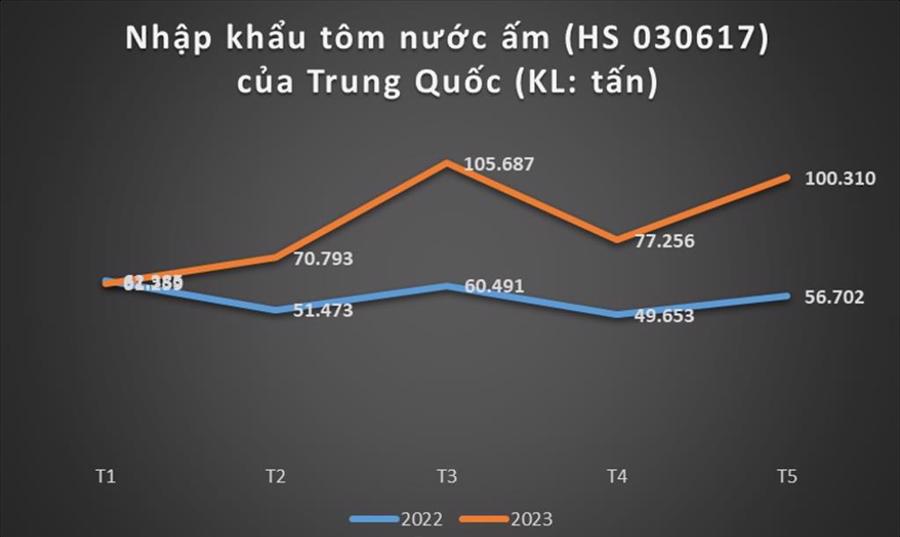

According to China Customs, the country’s shrimp imports rose sharply by 77% year-on-year to 100,310 tons in May; The import value increased by 55% to USD 579 million. In general, shrimp imports increased by 48% to 415,305 tons in the last five months; Revenue also rose 28% to $2.3 billion.

However, prices for imported shrimp remained low amid the global market decline. Accordingly, the price of imported shrimp averaged $5.77/kg in May, slightly above the same-year low of $5.33/kg in April.

It is known that Ecuador was a major supplier of shrimp to China in May with 72,520 tons, double the amount for the same period. Revenue also rose 70% to $392 million. However, the average unit price for 1 kg of shrimp fell by 16% to USD 5.41/kg over the same period.

India was second with 10,872 tons, up 30% year-on-year. However, sales increased by only 7% to $62 million as the selling price fell by 23% to $5.73/kg.

However, according to the Association of Seafood Exporters and Producers (VASEP), based on the data collected, it is estimated that the proportion of hanging non-agricultural ponds in India ranges from 30% to 50%; In Ecuador, EI Nino causes damage to around 30% of the farmed area, and the amount of shrimp will decrease.

According to VASEP, shrimp farming in China is currently very difficult due to high input costs and falling raw shrimp prices, so China will continue to increase shrimp imports from abroad. China’s demand for shrimp imports gradually recovered, and the volume almost doubled compared to the same period last year. However, prices for imported shrimp remained low amid the global market decline.

With developments in China’s shrimp production and import, Vietnamese shrimp stand a chance of regaining exports to the world’s most populous market. VASEP’s report shows that China ranked first in Vietnam’s shrimp consumption market in May with a 23% share. The US came second with 21%.

Shrimp exports to the Chinese market reached US$78 million in May, the highest since the beginning of this year. This number still recorded negative growth, but the decline was smaller than in previous months (March saw a 40% drop, April fell 22%, May fell 11%).

As for the stocking situation of shrimp in the country in the first 6 months of 2023, the stocking level of white leg shrimp in the country decreased slightly by 1.8%, while the stocking level of black tiger shrimp increased by 12.5% compared to the same period last year . In March of this year in particular, white leg shrimp stockings fell by 14%, while black tiger shrimp stockings increased by 10%.

The main provinces (Kien Giang, Ben Tre, Tra Vinh, Bac Lieu, Soc Trang, Ca Mau) recorded an increased stocking of black tiger shrimp in 5 provinces except Ca Mau in March 2023. The stock of white-leg shrimp in Kien Giang increased slightly, in Ben Tre, Bac Lieu and Ca Mau it decreased slightly; in Tra Vinh and Soc Trang the decline was more pronounced.

“Therefore, the forecast for Vietnam’s raw shrimp supply in July and the last months of the year could decrease, but not too severely,” VASEP said.

Regarding the production and export situation of the market in the coming period, VASEP said that although it is still a difficult period, many optimistic forecasts have been made about Vietnam’s shrimp export prospects in recent months. Years go into markets like China , America. Although it hasn’t recovered much compared to last year, it will at least be better than it was at the beginning of this year.

[ad_2]

Source link