[ad_1]

China lost its position as the top exporter of goods to the US in the first five months of 2023 – for the first time in 15 years – to Mexico and Canada.

According to the US Department of Commerce, US imports of Chinese goods fell about 25% year-on-year to $169 billion from January to May 2023.

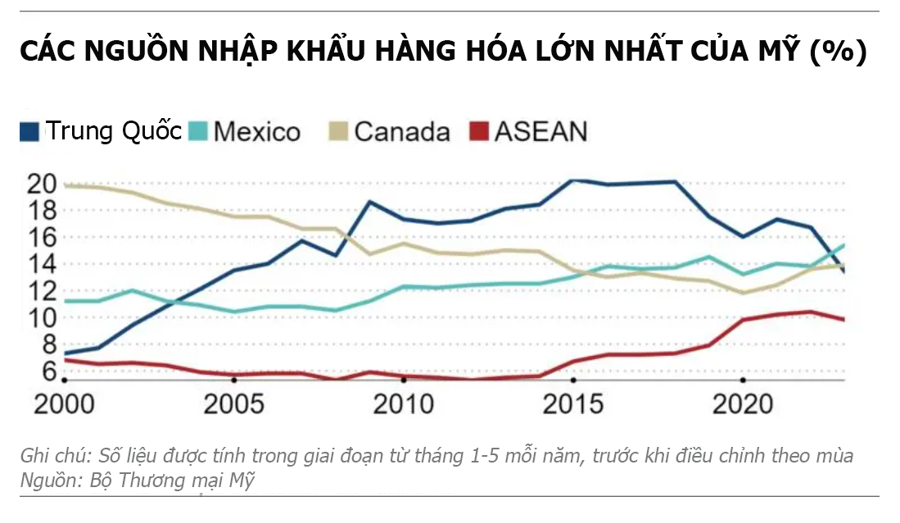

According to the study, China accounted for about 13.4% of total US imports, the lowest in 19 years and down 3.3 percentage points from the same period in 2022. Import sales fell in many categories, particularly semiconductors, which decreased by up to 50%.

Meanwhile, US imports of goods from Mexico rose to $195 billion, a record high for the first five months of the year, while imports from Canada rose to $176 billion.

At the same time, Southeast Asian countries also increased their exports to the United States. U.S. imports from the Association of Southeast Asian Nations (ASEAN) rose to $124 billion in the first five months of this year – the second-highest ever for the period. ASEAN’s share of total US imports has doubled over the past decade.

On the other hand, US exports to China for the first five months of the year were almost flat at about $62 billion. While still enough to make China the US’s third-biggest export market, US goods now account for 7.5% of China’s total imports, down from a 2020 peak of 9% and just under half of Mexico and Canada’s share.

In 2009, China overtook Canada to become the largest exporter of goods to the United States. As high-cost manufacturing in the US lost competitiveness due to the economic downturn caused by the financial crisis, China took advantage of its low production costs and centralized supply chain to gain a foothold in world trade. The country’s nominal gross domestic product (GDP) has nearly quadrupled, while total exports have grown 2.5-fold over the past 15 years.

However, China’s share of total US imports began declining under President Donald Trump, after peaking at around 20% between 2015 and 2018. The Trump administration has imposed heavy tariffs on about $370 billion worth of Chinese goods imported into the United States in a bid to revive domestic manufacturing industries.

Under President Joe Biden, the US government maintained these tariffs but sought to exclude the US from sectors such as advanced semiconductors and telecommunications equipment on national security grounds. Mr. Biden also called for a restructuring of the supply chain in four key areas, including chips and batteries.

In this context, American companies are reorganizing their production networks. Technology company Apple recently encouraged its suppliers in Taiwan and elsewhere to shift production from China to some Southeast Asian countries and India. Meanwhile, fashion retailer Gap is increasingly relocating production to Mexico and Central America.

Efforts to reduce dependency on China are also hurting the US as it pushes up consumer goods prices. However, the idea of mitigating the risks associated with China has the backing of lawmakers from both parties. The move to shift the supply chain to friendly countries (also known as friendshoring) has met with widespread support.

“Primarily, the pursuit of efficiency and low costs has left the supply chain vulnerable and at great risk,” US Trade Representative Katherine Tai said in June.

Meanwhile, the Chinese side is also aiming to Southeast Asia to export goods. Although exports to the US fell 17% yoy in the first half of 2023, China’s exports to ASEAN rose 2%. Some observers say Chinese exporters tend to shift their products to Southeast Asia for processing and from there to the US and other countries.

[ad_2]

Source link