[ad_1]

According to the Center for Digital Transformation and Agricultural Statistics, rubber exports reached 150,000 tons in February 2023 with a value of US$212 million. Cumulatively in the first two months of the year, our country exported 285,000 tons of rubber and brought in US$394 million, down 3.2% in volume and 23.1% in value compared to the same period in 2022.

CHINA IS STILL THE LARGEST CONSUMER MARKET

In the first two months of 2023, all rubber exports to major markets decreased compared to the same period in 2022, but exports to some markets like Taiwan, Russia, Japan, Netherlands, Malaysia… grew both in volume and remains good value compared to the same period in 2022.

As of February 2023, China was still the largest market for Vietnam’s rubber consumption, accounting for 75.35% of the country’s total rubber exports, with nearly 98.79 thousand tons worth US$133.56 million. In the first two months of 2023, Vietnam exported more than 206,000 tons of rubber to China worth US$277.45 million.

Center for Digital Transformation and Agricultural Statistics.

In terms of imports, the volume of rubber imports in February 2023 was 130,000 tons with an estimated value of US$179 million, bringing the volume and value of rubber imports to 273,000 tons and US$346 million in the first two months of 2023, respectively were estimated, a decrease of 40.9% in volume and 46% in value compared to the same period in 2022.

Previously, in 2022, Vietnam exported 2.14 million tons of natural rubber and brought in US$3.31 billion, up 9.6% in volume and 1.1% in value from 2021. Vietnam’s rubber export market is still primarily Asia, accounting for 90.6% of the country’s total rubber export value. Notably, rubber exports to Asia reached 1.86 million tons worth nearly $3 billion, up 12.9% in volume and 6.2% in value from 2021.

China is still Vietnam’s largest rubber consumption market with 1.5 million tons worth US$2.34 billion; up 14% in volume and 6.3% in value compared to 2021. The Chinese market accounts for 79.8% of Vietnam’s total rubber export value in 2022.

The second largest rubber export market is India, with exports to this market of 123.2 thousand tons worth US$218 million; compared to 2021, volume increased by 8.8% and value by 4.5%. The Indian market accounted for 6.6% of the country’s total rubber export value.

In addition, the markets in positions 3 to 5 are: Cambodia with 2.9%, South Korea with 2.5% and Turkey with 1.9%. The rest is exported to other markets.

RUBBER EXPORT PRICE QUOTE EXPECTATIONS

Although rubber export hit a new record sales of USD 3.31 billion in 2022, the volume of rubber exported last year was 2.6 times compared to 2011, while the sales value was only slightly higher. This shows that the export price per tonne of rubber latex is only 40% of what it was 11-12 years ago. The average export price of rubber in 2022 is only $1,547/ton, down 7.8% from 2021.

Usually the first months of the year are the dry season, rubber plantations stop mining rubber, supply falls, so rubber prices often rise in the first quarter of the year. This year, however, the decline in rubber export prices in the first few months of the year is quite unusual.

At the end of December 2022, the Import-Export Department (Ministry of Industry and Trade) issued a forecast: In the coming period, the price of natural rubber will give more positive signals. In mid-December, the US Federal Reserve decided to raise interest rates more slowly. This is positive news for the global economy and may support speculative buying in the rubber market.

Meanwhile, the Chinese market has almost no natural rubber production in the first 3 months of 2023. Due to the extremely low temperatures, rubber farmers in China stop harvesting in mid-December every year. After the extremely low temperature season, the rubber tree will drop leaves and change leaves.

“China expects rubber supply to become tight starting in February, the period when rubber trees in major producing countries enter the annual foliage season,” the import-export department said.

From January 2023, China lifted the zero-Covid policy, the border gates on the border with Vietnam simultaneously reopened the customs clearance of goods as before the Covid pandemic. The Chinese market accounts for 80% of Vietnam’s total rubber export value, so many experts are predicting that rubber exports to China will recover in both volume and export price.

“The average rubber export price to China in 2022 is USD 1,490 per tonne, down 9% from 2021. In the first two months of 2023, the export price of rubber to China fell by 7.9% compared to the average price for this market in 2022 and fell by 19.7% compared to the first of February 2022.

Center for Digital Transformation and Agricultural Statistics.

But contrary to the forecast, the average rubber export price in the first two months of 2023 was only US$1,384/ton, down 20.6% from the same period in 2022. In February 2023, the average export price of rubber army fell by 21.1% compared with February 2022. For the Chinese market alone, the export price of rubber was only USD 1,372/ton in February 2023.

According to the Center for Digital Transformation and Agricultural Statistics, the fall in rubber export prices is due to fluctuations in the global market. In January 2023, the price of rubber on the world market fell continuously on two major stock exchanges.

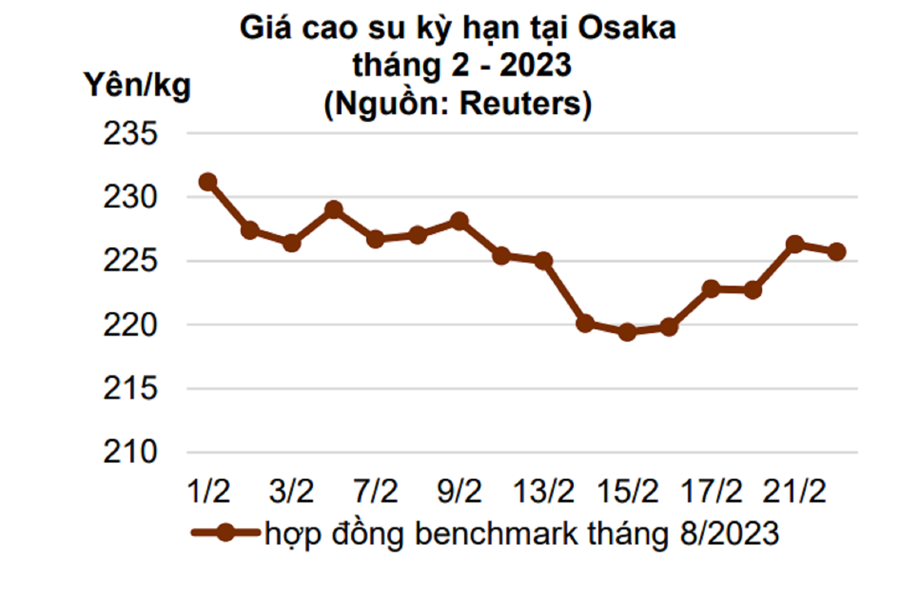

By February 2023, rubber prices in the Asian market continued to decline. The rubber price on the Osaka (Japan) floor on February 22, 2023 for the benchmark contract for delivery in August 2023 was 225.7 yen/kg, down 5.5 yen (equivalent to 2.4%) in the Compared to the first trading session in February 2023 is . As the February low fell on Feb. 15, the August 2023 contract closed at just 219.4 yen/kg.

Global rubber prices showed signs of recovery in the days of February 15-21, 2023. However, from February 22, 2023 to this date (March 22, 2023), rubber prices continued to decline.

In the morning session on March 22, 2023 at the time of polling at 6:15 a.m. (Vietnam time) on Tokyo Commodity Exchange (TOCOM), the price of rubber for delivery in March 2023 reached 195.0.8 yen/kg, a Down 2.2% (equivalent to 4.3 yen/kg) from mid-month.

A Reuters poll showed that Japan’s manufacturing sector remained gloomy in February, suggesting a global slowdown is holding back the country’s recovery. Meanwhile, slowing Chinese auto demand also weighed on market sentiment.

According to the Association of Natural Rubber Producing Countries (ANRPC), the natural rubber harvest is expected to reach 14.693 million tons in 2023, of the global natural rubber demand is only 1.048 million tons. Thus, in 2023, rubber supply will exceed demand, pushing the rubber industry into a new recession cycle.

[ad_2]

Source link