[ad_1]

In the first nine months of 2022, the export value of seafood rose a record 38 percent year-on-year to $8.5 billion. VASEP forecasts 13% and 55% year-on-year growth in shrimp and pangasius exports, respectively, for 2022 as a whole.

This strong growth was supported by many positive factors: (1) post-COVID recovery demand; (2) the Russo-Ukrainian war caused a shortage in the world supply of whitefish; (3) Inflation increases the need to hoard food.

After peaking in the second quarter of 2022, the export value of seafood has shown signs of slowing down in recent months, although it is still higher than the same period last year. The slowdown in seafood exports comes as many retailers rushed to import in the first half of 2022 amid high inflation, which is dampening people’s spending and leading to high inventories.

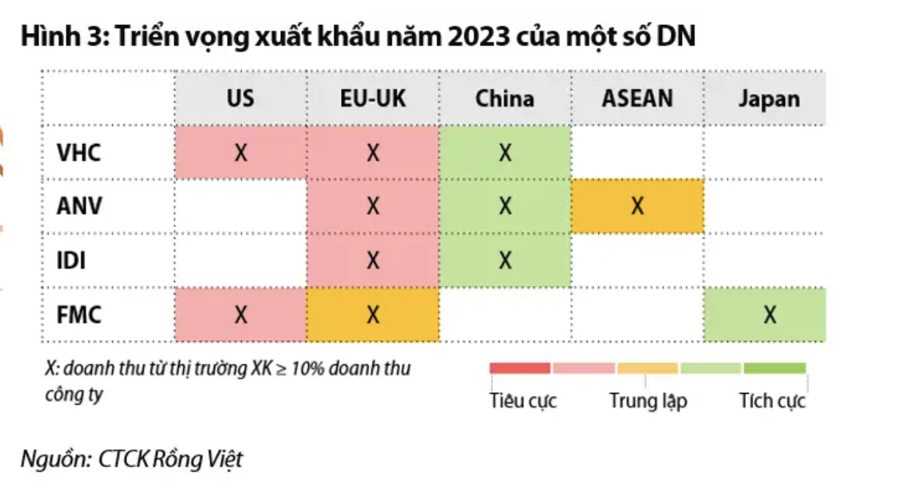

In the recently released seafood industry prospectus report, Rong Viet Securities said that due to the lack of favorable supporting factors, the export value of seafood in 2023 will enter a downward cycle, but will remain at a higher level than in the period of 2020-2021. Since then, seafood is still an important food, the demand will not fall sharply.

At the same time, the supply of Vietnamese pangasius is also kept at a moderate level, so there will not be a sharp drop in raw material prices, which will lead to a drop in sales prices as in the 2018 – 2019 period.

China’s opening up is a bright spot to support Vietnam’s fish exports. The VDSC expects China to reopen its economy after the “Zero Covid” policy in 2023. If the restaurant channel recovers, pangasius exports to that market will recover accordingly.

As of July 2022, although China no longer implements quarantine on frozen products, pangasius exports to this market are still relatively weak due to low demand for food services. However, there is concern that the plentiful supply of tilapia from China will put pressure on pangasius import demand and export prices due to competition.

Therefore, opening up China will only help ease the pressure on Vietnamese pangasius exports, not the export boom to that market.

In addition, a sharp drop in freight rates will also support the seafood industry in the coming period. High logistics costs are the bottleneck for seafood companies’ profit growth in recent years. Lowering freight rates helps partially offset the profit margin of companies impacted by lower selling prices.

The VDSC assumes that the transport costs of fish companies will fall sharply from Q4/2022. Shipping costs for businesses will return to normal from 2024.

Industrial stocks hit their lowest P/E in 5 years. VDSC believes that the Pangasius share price may come under pressure in 2023 if business results show a sharp decline from the high base level of 2022. The demand side may again mark the industry uptrend.

For the shrimp industry, the export figures of the first half of 2023 are forecast to be under pressure from a high base of the first half of 2022. However, a gradual recovery in demand is expected in the second half of 2023.

[ad_2]

Source link