[ad_1]

The government has just issued Decree 85/2022/ND-CP of October 24, 2022 on the Financial Settlement Mechanism for Vietnam Oil and Gas Group (PVN) in paying price compensation when purchasing their products. Nghi Son refinery and petrochemical complex project.

This decree sets out the financial handling for Vietnam Oil and Gas Group when paying price compensation in the offtake of products from the Nghi Son Refinery and Petrochemical Complex project under the fuel product offtake agreement signed between The Vietnam Oil and Gas Group and Nghi Son Refining and Petrochemical Limited Liability Company, Implemented Item 4 of National Assembly Resolution No. 42/2021/QH15, including: Determining the needs and policies of government in dealing with financial assets. Preparing estimates, auditing, closing the state budget and dealing with the difference between revenues and input costs of the project’s product outsourcing activities in determining the annual business results of the parent company – Vietnam Oil and Gas Corporation.

The decree clearly states that the State will provide financial compensation to PVN in paying price compensation for the actual products received by the Nghi Son Refinery and Petrochemical Complex Project, but no more than 10 years from the date PVN paid the Products of the project officially consumed according to the following principles:

If the result of the implementation of the offtake chain generates interest in the year, the state will not handle the price compensation in the offtake that Nghi Son Oil Refinery Distribution Branch (PVNDB) has to pay to the refinery company Nghi Son Petrochemicals corresponds to the amount of in the year sold consumption.

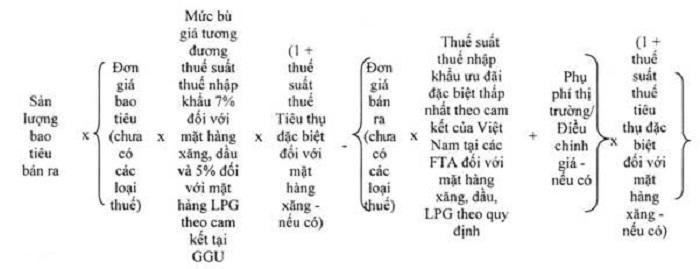

In the event that the results of the implementation of the acceptance chain in the year cause a loss, the amount of money that the state will handle financially for PVN is determined in accordance with the regulations, but the maximum amount does not exceed the difference between the total amount of compensation that has accrued in the year (including market surcharge/price adjustment, special excise tax (if there is a structure in purchase price) that PVNDB is required to pay to Nghi Son Refinery and Petrochemical Company compared to the amount received by dealers with gasoline and oil trading hubs or other buyers are required to pay PVNDB – Pay import taxes, excise duties – where applicable – and market surcharges/price adjustments from the sale of petrol, oil and LPG products.

Where: The difference corresponding to each sale is determined as follows:

The determination of the maximum amount of money that the state can financially handle for PVN is based on the difference between the total amount of price compensation accruing in the year and the total amount owed to major petroleum and oil traders or other buyers. Payment to PVNDB according to above formula applied in case of lowest Special Preferential Import Tax Rate under Vietnam’s obligations in Free Trade Agreements (FTAs) for Gasoline and Oil Products. , LPG according to regulations, the structure in the sale price is more than 0%.

If the amount determined according to this point and the above formula is greater than the deduction compensation, the amount of the financial settlement of the State for PVN will be equal to the deduction compensation according to the provisions of point b, clause 6 of this article 4 of this decree.

If the lowest special preferential import tax rate is equal to 0% according to Vietnam’s commitments in free trade agreements for gasoline, oil and LPG products according to the sales price structure regulations, the maximum amount of government financial processing for PVN determined by regulation is but not more than Amount of the withdrawal fee.

The amount of money that the State will handle financially for PVN will be determined after excluding offtake volume in excess of performance under the offtake volume provisions in the first signed offtake agreement (January 15, 2013); the output does not meet the quality standards specified in the outsourcing contract and the National Technical Regulation (QCVN) of Vietnam in accordance with the law.

The Decree clearly states that after the National Assembly approves the annual Central Budget Expenditure (NSTW) for the needs of the amount of money requested by the State for financial settlement for PVN in the fiscal year, PVN is entitled to temporarily use quarterly after-tax profit to pay the in the decrease charged price, but not more than the expenditure estimate for this item.

The government requires PVN to ensure the payment of price compensation to Nghi Son Refinery and Petrochemical Company which does not exceed the off-take contract performance (according to the off-take volume set at the time of signing the first off-take contract on January 15, 2013) and does not cover the output which does not meet the quality standards prescribed in the consumption contract, does not comply with the QCVN of Vietnam according to the law.

does not exceed the performance according to the outsourcing contract.

PVN is responsible for the negotiation results, the signing of the offtake agreement, the after-sales product agreement (including the terms of the offtake price and sale price formula) and the effectiveness of the implementation activities to ensure that PVNDB at the end of the implementation of the in does not suffer accumulated losses under the funding mechanism prescribed by this Decree.

PVNDB is obliged to pay Nghi Son LHD Company in the acceptance phase according to the quantity sold.

For the Committee on the Management of State Capital in Enterprises, the government required PVN and PVNDB to monitor and inspect the implementation of the take-off chain, the payment of price compensation, and the temporary use of the capital for production and enterprise to pay the prescribed price compensation.

The Ministry of Finance is responsible for including it in the central budget and carrying out the procedures for reporting to the competent authorities in accordance with Section 3, Article 6 of Decree 85 for the approval of the annual state budget for the demand will be requested by the state for financial settlement determined by PVN according to the provisions of Article 4 of Decree 85.

At the same time, summarize in the annual final report of the state budget, report to the government and submit to the National Assembly in accordance with the law on the state budget the amount of money that the state manages financially for PVN in accordance with the regulations on the basis of the law on the state budget, on the basis of the audit results of the State accounts and the approval of the final report of the Supervisory Board of the PVN.

The government requested the Ministry of Industry and Trade to be responsible for overseeing the production plan of Nghi Son Refining and Petrochemical Company and PVN and PVNDB to implement the supply chain of Nghi Son Refining gasoline, oil and LPG products to organize and Petrochemical Company.Paint is in line with the commitment in the Agreement signed between the Government of Socialist Republic of Vietnam and Idemitsu Kosan Co.,Ltd. Mitsui Chemicals, INC.; Kuwait Petroleum Europe BV and Nghi Son LHD Company on January 15, 2013 January 1, 2013 for Nghi Son Refinery and Petrochemical Project (GGU).

At the same time, notify the time when PVN formally takes over the products of Nghi Son Refining and Petrochemical Project based on PVN’s report, and send it to the authorities and units mentioned in Sections 1, 3, 4 and 5. Article 2 of Decree 85 to organize the implementation, supervision and surveillance according to the regulations.

For the state audit, the government requires an audit of the amount that PVN requires the state to settle financially for PVN before submitting the annual audit report of the state budget to the National Assembly, as required by Section 2, Section 3, Article 8 of Decree 85.

In addition, there are opinions on the estimation of the need of the amount of money requested by the State to deal with the financial situation of PVN in the implementation of Section 5, Article 10 of the Law on State Audit, based on the report of PVN as required in Clause 5, Article 10 of the State Audit Act 2 Article 6 Decree 85.

[ad_2]

Source link