[ad_1]

FIT price race (fixed electricity tariff for 20 years) ended more than 1 year ago. However, 34/84 transitional energy projects totaling 2,090.97MW capacity including: 28 wind power projects of 1,638.35MW and 6 solar power projects of 452.62MWac have been completed, however, due to the ongoing Covid-19 pandemic, we have not been able to enjoy them the state-prescribed fixed electricity price (FIT price). That is: Decision No. 39/2018/QD-TTg of September 10, 2018 amending and supplementing a number of articles of the Prime Minister’s Decision No. 37/2011/QD-TTg of June 29, 2011 on mechanisms to support development of Wind Power Projects and Decision No. 13/2020/QD-TTg of April 6, 2020 on the Mechanism for Promoting the Development of Solar Energy in Vietnam.

USE MONEY “FIGHT”

Exchange with Vietnam Economic Review/VnEconomy, Dr. Hoang Giang, general manager of Sunpro Wind Power, investor in Sunpro’s 30MW Ben Tre wind farm project, said these transitional projects cost more than those completed early. Since the project has no revenue, the electricity price will be reduced by more than 20% from the old price, causing many additional costs, so the end result is a loss. “As soon as the financial plan fails, it is clear that the investor will soon go broke,” fears Mr. Giang.

According to Mr. Giang, most of the above projects are behind schedule due to force majeure caused by the Covid-19 pandemic, equipment procurement and transportation fell at the right time of the blockade, causing delays in the procedures. The mobilization of Personnel is difficult because of prolonged isolation, especially for foreign experts.

According to Mr. Bui Van Thinh, chairman of the Binh Thuan Wind and Solar Power Association, tens of billions of VND investment projects that have not been put into operation will certainly have no revenue, investors cannot repay them. The disastrous consequences, which are difficult to assess, if the project is not put into operation soon or at too high a price, will further increase bad debts at the banks.

Well, projects that borrow up to 70-80% of the capital leave many wind and solar investors “standing still” as they “carry” huge bank debt and high lending rates.

“The unreasonable purchase price of electricity will make investors abandon the project, mutual money will of course be lost, and the bank will tighten the debt. Interest rates depend on each project because each project has its own source of credit, but with the current high interest rate, it’s extremely dangerous,” Thinh said.

Of concern is that the financial burden on renewable energy companies is growing. According to Fiinratings statistics, bonds financing renewable energy projects surged in 2019-2021, accounting for 70-85% of the total value of energy bonds issued with long maturities averaging 7-8 years. The reason energy companies have been busy raising debt capital in recent years is because investors are racing to operate commercial operations (CODs) to receive FIT preferential pricing on solar and wind power projects. However, with many investors using high leverage and the project has no cash flow, companies in the renewable energy sector are facing many financial difficulties, especially the instability of the bond market. Recently, companies have forced them to buy back bonds before maturity.

For example, out of 34 projects with COD-free capacity, there is Trung Nam – Thuan Nam Solar Power Plant with the largest capacity of 172.12MW, operated by Trung Nam – Thuan Nam Solar Power Company Limited (belonging to Central Vietnam Nam Group) as an investor. Recently, Trung Nam Group has mobilized a huge amount of debt capital to develop the solar energy segment, with total debt mobilization from 2019 to date of nearly VND 34,000 billion.

Due to high interest rates, the average collection period for utility bills increased sharply, which affected companies’ cash flows, leading Trung Nam to make many announcements about late payment of bond interest. Most recently, on March 22, the Hanoi Stock Exchange announced an unusual report on the payment of principal and interest on the bond with code TNGCH2223001. Accordingly, on March 16, Trung Nam Group repaid all 9.37 billion dongs of the interest of the TNGCH2223001 lot, but only repaid 80 of the 400 billion dongs of the principal of this bond lot.

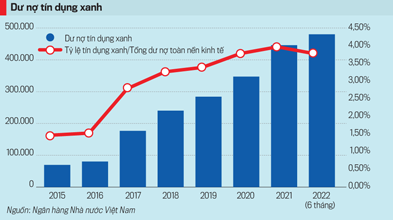

In recent times a number of banks such as HDBank, Sacombank, VPBank, SHB, OCB… have introduced massive lending programs for renewable energy projects with very high lending rates. For example, in Sacombank, HDBank, the loan ratio is 70% of the project investment capital requirement, VPBank is 80%, VietCapital Bank is up to 85%… This makes the outstanding loan balance for green lending projects hundreds of trillion dongs from banks. According to the Credit Department of Business Sectors (SBV), the outstanding loans for green projects will reach more than VND474 trillion by mid-2022, accounting for 4.1% of the total outstanding loans of the entire economy, compared to an increase of 7.08% by 2021, with a main focus on renewables and clean energy (47%).

Projects that borrow up to 70-80% of the capital leave many wind and solar energy investors “standing still” as they “carry” huge bank debt and high lending rates.

INVESTORS ONLY FEAR POLITICAL RISKS

However, the damage from the new policy is why investors are discouraged. According to information from VnEconomy, many investors and projects that cannot bear the costs involved are planning to liquidate machinery and equipment that has invested up to hundreds of billions of dongs in order to have money to repay bank loans. Many projects also had to regret selling to limit losses, and eventually some traders forced reasonable prices to work at any cost and the future was calculated later. Many Vietnamese investors even announced that they are suspending projects and cutting jobs in Vietnam, but actually chose another country to invest. This is very worrying.

At the beginning of 2023, the Ministry of Industry and Trade based on calculations by Electricity of Vietnam (EVN) adopted the LCOE range for solar power plants and transitional wind power plants in Decision No. January 7, 2023 to a halt. Accordingly, the price of geothermal solar power is VND1,184/kWh, 29.5% below the previously announced FIT price. The price of onshore and offshore wind power is also about 21% lower at VND1,587/kWh and VND1,816/kWh respectively.

Obviously, this price range is 21-29% lower than the FIT pricing mechanism, which is disappointing for many investors who have waited too long and not every project will bring an effective profit. …

The content of the article was published in Vietnam Economic Review No. 14-2023, issued on April 3, 2023. Welcome readers to read The:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-king-te-viet-nam

[ad_2]

Source link