[ad_1]

In the first three quarters of 2022, most livestock companies reported mixed results with tight profit margins due to rising costs.

THE POINT PRICE IS A LITTLE HARD TO INCREASE DUE TO LOW DEMAND

Accordingly, DBC announced net sales growth of its core business (excluding real estate) of 13% year over year, while net income fell 68% year over year on profit margin. Gross margin decreased 800 basis points mainly due to the increase in livestock costs when feed costs were high.

BAF posted a 46% decline in net sales but still posted 17% year-over-year profit growth. BAF recorded a doubling of livestock revenue in the first 3 quarters of 2022 (starting from a low base of comparison). BAF has made a transition from trading raw materials to growing its own crops, which helps increase net profit.

Similarly, HAG’s livestock segment revenue increased 125% year over year from a low baseline, while its livestock segment gross profit margin declined 720 basis points.

In the first 9 months of 2022, MML recorded livestock segment revenue of VND663 billion (down 6% YoY) and a gross profit margin of 24.5% (a significant decrease from 36.9%) in the first 9 months of 2021 ) due to lower hog prices and higher feed costs.

Data from the General Statistics Office shows that live pig production increased by 12.4% in the first 11 months of 2022 over the same period (up 4.3% in the first quarter, 7% in the second quarter). up 7% in the third quarter over the same period).

According to SSI Research’s assessment, while the ASF outbreak in farm households will not yet be fully under control, it will not impact the overall pork supply as the disease is not as severe this time as before and the introduction vaccination is expected to start next year after the pilot phase is completed.

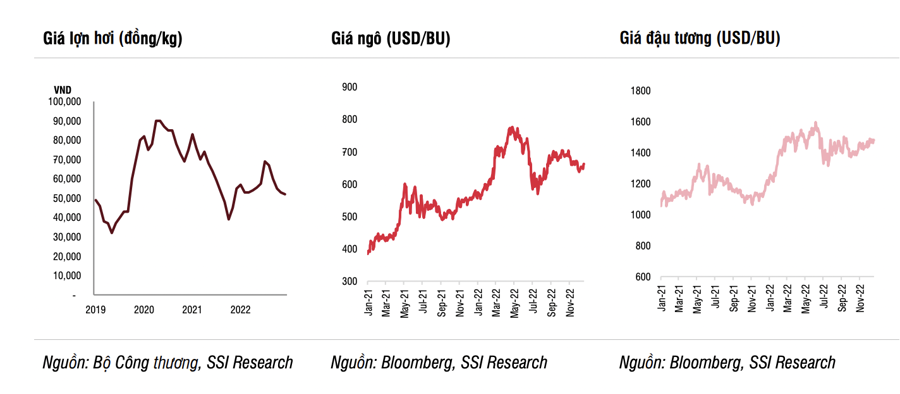

The price of live pigs remained stable in the first half of 2022, averaging VND 55,000/kg (down 25% YoY), then increased significantly in July and August, reaching a peak of VND 70,000/kg. This development was short-lived, however, as China subsequently imposed stricter restrictions on border trade as part of the country’s Covid19 control policy. Since then, the average live pig price has adjusted to VND 53,000/kg in the fourth quarter of 2022 (up 15% year-on-year).

Live hog prices are often heavily influenced by seasonality in the fourth quarter, and demand usually increases ahead of the Tet holiday. This year, however, demand does not appear to be increasing. This is partly due to weaker consumer confidence amid inflationary pressures.

In terms of costs, commodity prices, notably corn prices rose 17% yoy, wheat prices rose 60% yoy, and soybeans rose 10% yoy. Prices for these commodities peaked in the second quarter of 2022, then slowed in the second half of 2022, rising just 10% for corn and 25% for soybeans, while wheat prices fell 2% compared to the same period.

However, the cost of feed has not yet cooled down and the price reduction is taking place more slowly than expected. Feed costs usually need some time to adjust downwards, because feed manufacturers have long suffered from high import costs, and the situation is more difficult in the long term.

As a result, feed costs have increased by 38% year-on-year and have doubled from 2020, severely impacting not only farm households but also commercial operations due to high feed costs. Raw materials make up 75% of the total cost of livestock.

The average production cost of household farm is estimated at 55,000-60,000 VND/kg, while the average production cost of commercial farm is estimated at 50,000 VND/kg. With an average live pig price of VND 55,000/kg in 2022, ranchers are hardly profitable.

Although 3F (Feed-FarmFood) commercial operations are not as badly affected as domestic operations, profit margins are still much lower than in previous years. Commercial farm profits are now at their lowest level in 5 years.

LIVESTOCK TO RECOVER FROM 2023

Regarding the prospects for the near future, data from the OECD show that the per capita consumption of pork has decreased compared to the average consumption before the pandemic, notably from 31.4 kg/person/year in 2018 to 26.8 kg/year. person/year in 2022 This also points to the possibility that in 2023 this number will increase by around 3% over the same period.

With livestock production rising sharply in recent months (up 12.4% yoy in the first 11 months of 2022), live pig supplies are unlikely to run short in 2023 provided the disease subsides brought control. Therefore, hog prices are not expected to increase dramatically. It is forecast that the price of live pigs will reach around VND 60,000/kg in 2023 (up 10% over the same period).

On the cost side, feed costs are forecast to stabilize and begin to decline in the second quarter of 2023. Therefore, SSI Research predicts that livestock costs will decrease in 2023, while live pig prices are expected to slowly increase.

Accordingly, livestock farms are forecast to start recovering in 2023. The reopening of China will be the catalyst to watch in this sector as cross-border trade will support hog prices in 2023. Official hog exports to China could also be a catalyst.

However, this is unlikely as there are many regulations regarding provenance and food safety. Commercial farms with a fully integrated ‘3F model’ will be the main beneficiaries if this is adopted.

[ad_2]

Source link