[ad_1]

On the afternoon of December 31, the Directorate General of Taxation just issued the Official Dispatch No. 15/CD-TCT (Dispatch 15) to the Provincial and Centrally Governed Cities Treasury Departments and the Provincial and Centrally Governed Cities People’s Committees to coordinate and direct the Implementation of the application of environmental tax rates to petrol, oil and grease, as mandated by Resolution No. 30/2022/UBTVQH15 of 30 December 2022 of the Parliamentary Service Standing Committee.

ENVIRONMENTAL TAX CLEANING BY THE END OF 2023

According to the contents of the official message 15, on December 30, the Standing Committee of the National Assembly issued Resolution No. 30/2022/UBTVQH15, which establishes the environmental protection tax rate for gasoline, oil and grease with three specific contents.

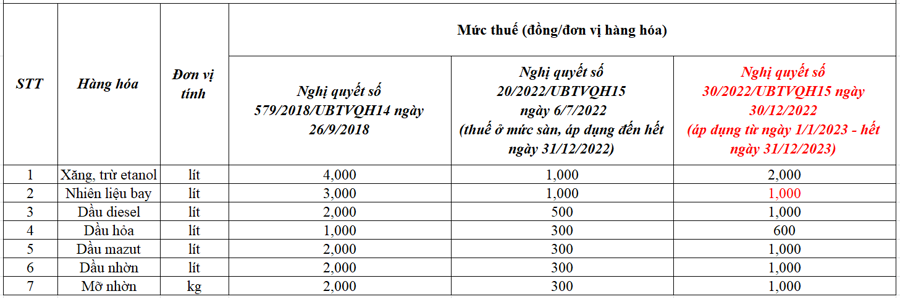

Firstthe environmental protection tax rate for gasoline, oil and fat from January 1, 2023 (the effective date of this decision) to the end of December 31, 2023 is regulated as follows:

As a result, the environmental tax on kerosene alone will remain at the minimum level, as it was in the second half of 2022. Other items reduce the environmental tax by 40-50% compared to the provisions in Resolution No. 579/2018/UBTVQH14 of September 26, 2018 and 2-3 times higher than the ground level applied in the second half of 2022.

The pollution tax on gasoline will be reduced from VND 4,000/liter to VND 2,000/liter.

Aviation fuel from 3,000 VND/liter to ground level from 1,000 VND/liter.

Diesel oil reduced from VND 2,000/litre to VND 1.00/litre; Kerosene from VND 1,000/litre to VND 600/litre; Heating oil, lubricating oil reduced from VND 2,000/litre to VND 1,000/litre.

Fat reduced from 2,000 VND/kg to 1,000 VND/kg.

Second, The environmental protection tax rate for gasoline, oil and grease from January 1, 2024 must comply with the provisions of Section I, Section 1, Article 1 of Government Decision No. 579/2018/UBTVQH14 of September 26, 2018. National Assembly Standing Committee on Environmental Protection Tariff.

Tuesday, does not apply the environmental protection tax rate to gasoline, oil and grease as set out in Section I, Section 1, Article 1 of Resolution No. 579/2018/UBTVQH14 of the Standing Committee of the National Assembly of September 26, 2018 from the date of publication. This decision is valid until the end of December 31, 2023.

The general tax department requested the tax department to actively disseminate, disseminate and guide the taxpayers in the region, while directing the provincial and city tax authorities to implement and bolster the application of tax rates for gasoline and oil without delay, as stipulated in Resolution No 30/2022/UBTVQH15 required above.

NO DISCOUNT ON ANY ITEM

Regarding the size of the tax cut, the Ministry of Finance has proposed reducing the environmental protection tax to the minimum level by the end of 2022, but many opinions in the National Assembly Review Board believe that the current context of world crude oil prices at the end of 2022, compared to the beginning of the year, shows signs of cooling has shown, the crude oil price forecast in 2023 is also below the average estimate in 2022.

Therefore, the government’s proposal to continue to apply the lower limit in the environmental tax bracket for all petrol, oil and grease products according to Resolution No. 20/2022/UBTVQH15 is unrealistic, persuasive, not in line with the nature and objectives of the Environmental Protection Tax.

At the same time, it may damage Vietnam’s reputation for implementing solutions to reduce harmful environmental impacts.

Therefore, from 2023, a new resolution on the environmental protection tax rate of 50% reduction in the environmental protection tax rate will apply to petrol (except ethanol), diesel oil, heating oil, lubricants and fats.

At the same time, the environmental protection tax rate for kerosene will be reduced by 70% compared to the top tax bracket.

A tax cut of this magnitude leaves room for further adjustments if the need arises later.

BUDGET SUPPORTS TO SUPPORT GASOLINE PRICE RISE IN 2023

Since the environmental tax is one of the factors that determine the retail price of gasoline in the country, the Treasury Department said the adjustment to lower the environmental tax rate will reduce the tax cost in the retail price structure of gasoline. it will help curb the rise in domestic gasoline prices but cause a deficit in budget revenue.

At the same time, “preventing gasoline prices from rising too high by lowering environmental tax rates on gasoline, oil and grease will help lower CPI, curb inflation and limit negative impacts on the economy,” according to the Treasury Department assess the impact.

Accordingly, lowering the pollution tax on gasoline, oil and fat for people will directly reduce people’s cost of consuming gasoline, oil and fat; At the same time, the indirect costs of other consumer products are reduced. As a result, households will have an additional portion of their spending, increasing the aggregate demand of the economy.

As for the manufacturing industry, especially companies that use petroleum as an input for production activities such as transport, transportation, fisheries, gas supply, chemical production, etc. will benefit more when the directive comes into effect.

According to analysts, this is one of the government’s major efforts to help reduce production costs and product prices; In doing so, they help companies increase their resilience and expand production and business, as well as control inflation.

[ad_2]

Source link