[ad_1]

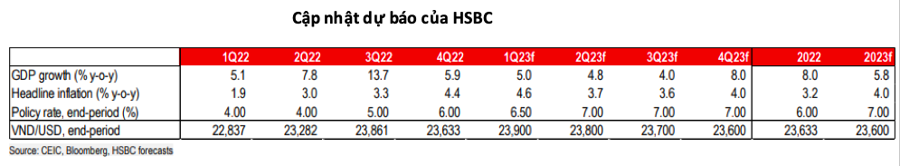

In the recently released Vietnam at a Glance report, HSBC said Vietnam is the first country in Asia to release figures for 2022 with impressive numbers for a challenging year. Vietnam’s economy grew by 5.9% in the fourth quarter compared to the same period last year. This result brings the full year 2022 growth to 8.0%, which is Vietnam’s highest growth rate since 1997.

However, HSBC also noted, “Vietnam shouldn’t rest on the laurels because beneath this beautiful growth number is hiding”. The reason behind HSBC’s above statement is that Vietnam’s favorable factors are decreasing.

In particular, the recovery of Vietnam’s tourism industry has been slow compared to other countries in the region. In 2022, Vietnam will welcome approximately 3.6 million visitors, reaching 70% of the target set at the beginning of the year. However, this level is only 20% compared to 2019, below Singapore’s 28% and Thailand’s 25%.

In addition, Vietnam’s somewhat gloomy manufacturing situation is a reflection of the flagging external sector, as Vietnam is particularly vulnerable to faltering demand from Western countries. While exports fell 14.0% in December compared to the same period last year, the slowdown was largely in key industries, notably electronics. On the contrary, imports also fell sharply by 8.1% year-on-year, mainly in imports of technology-related products. This is understandable given that Vietnam is in a position to “be at the forefront” affected by the global tech cycle that is “cooling off” as the production of electronic goods requires a lot of imports.

“Vietnam’s manufacturing outlook is beginning to face a challenge as the latest PMI slides further to 46.4 in December, the lowest level in 1.5 years,” the HSBC report said.

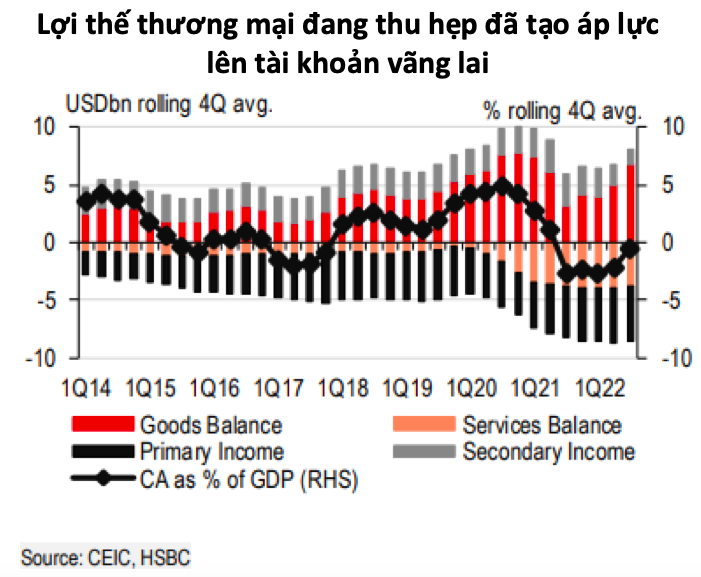

In addition, Vietnam’s overall trade balance advantage is narrowing again in the first half of 2022 due to slowing exports and high energy imports. This leads to a trade surplus that will only reach USD 4.1 billion (1% of GDP) in 2022. It is unlikely to reach that the trade surplus offsets the deficit in key income and services.

Therefore, Vietnam is likely to post a modest current account deficit for the second year in a row, which is likely to fall to around 1.4% of GDP, hampering the VND recovery. In fact, the VND has come under a lot of pressure to depreciate against the strong USD, weakening the current account and reducing the benefit of yield differentials.

To protect the local currency, authorities have sold foreign exchange reserves, which have fallen 20% by the third quarter of 2022 from the peak in late 2021. Improved USD liquidity has helped ease VND pressures somewhat. Nevertheless, the VND appreciation is likely to be a gradual process.

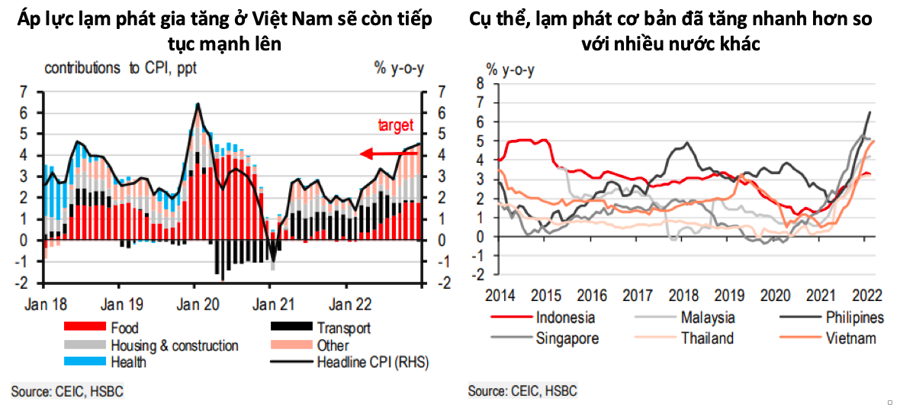

Finally, according to HSBC, despite relatively low annual inflation of 3.2%, Vietnam continued to face mounting inflationary pressures. December was the third month in a row that inflation exceeded the 4% ceiling set by the State Bank of Vietnam. Not only did core inflation rise to 5% yoy, Vietnam also saw commodity prices surge. This means that the state bank is expected to continue the tightening cycle.

“As the last central bank in ASEAN to adjust, the State Bank has actively caught up with the broader trend, raising interest rates by 200 basis points in 2022. While we expect the State Bank to slow monetary tightening as the Fed is expected to slow down and reduce foreign currency volatility, the rate hike cycle will continue. We expect the State Bank to increase the refinancing rate in the first quarter of 2023 and the second Q1 2023 to zero, 5 basis points, increasing funding to 7.0% by mid-2023,” said the HSBC research team.

[ad_2]

Source link