[ad_1]

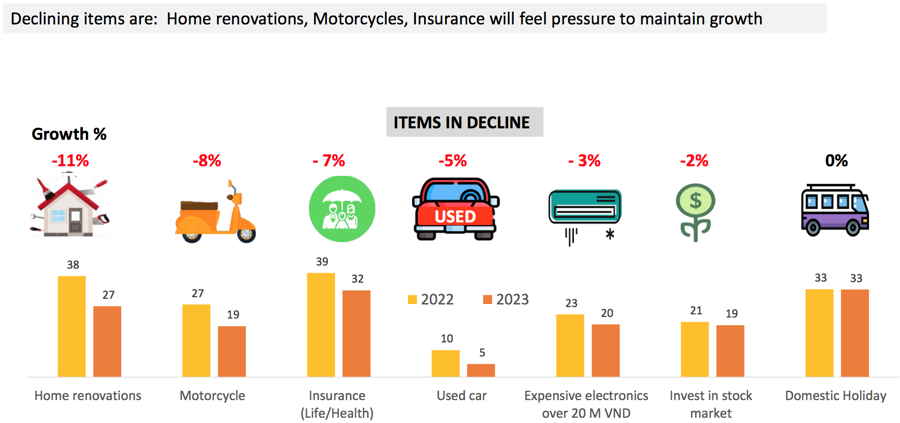

People will cut back on home renovations, car purchases, insurance, expensive electronics, and stock investments.

INCREASING INFLATION INCREASES COSTS

The report “Consumer Confidence Index January 2023” by Mr. Ralf Matthaes, CEO of Infocus Mekong showed that the labor and employment index has reached high levels compared to before the Covid-19 epidemic, although many real estate companies are laying off employees let , many factories laid off staff.

“This is a good sign for the economy, but if the employment problem is not solved well, unemployment will also rise,” said Ralf Matthaes.

According to Mr. Ralf Matthaes, after the outbreak of Covid-19, people’s other incomes (not salaries) are increasing again, but still lower than before the epidemic. Income from shares, financial investments and savings accounts for 35%; Real estate sales and rentals accounted for 32%; Online sales accounted for 32% and direct sales for 27%.

However, traditional ways of making money are being negatively impacted, causing people’s confidence to decrease somewhat. This shows the uncertainty of the market caused by the real estate bubble, which tends to increase inflation.

According to the General Statistics Office, the consumer price index (CPI) increased by 0.52% in January 2023 compared to the previous month and by 4.89% compared to the same period last year. The main reasons are high food prices and rents.

Therefore, the biggest concern of consumers today is not the Covid-19 epidemic but rising inflation followed by pollution, slow economic growth, rising unemployment and then the negative impact of the Covid-19 epidemic on business.

Expenditure on education and health usually comes first. However, following the outbreak of Covid-19, healthcare spending has fallen due to rising inflation, and spending on food has also risen sharply.

Spending on education is projected to grow 30% more in 2023, followed by spending on food and drink by 28%, health care by 19%, home appliances by 15%, vehicles by 10%… while electronic devices continue to grow to struggle Entertainment and hospitality – growth prospects for the first time since the outbreak of Covid-19. Therefore, spending on daily necessities will account for 60% of the total spending of many families, and savings will also increase.

In addition, consumers are increasingly borrowing from banks and financial firms, while sources of credit from friends and family have plummeted.

The purposes of consumer credit are also changing. If before the Covid-19 epidemic, especially in 2022, they borrowed mainly for business purposes, which accounted for 36%, then they came for personal consumption, essential expenses, real estate investments, paying off debts … But in 2023 the Purpose of borrowing mainly for essential needs with 38% and for personal needs with 42%, then business goals, real estate investments…

CONTINUED SPECIFICATIONS

According to Mr. Nguyen Anh Duc, director-general of Ho Chi Minh City Union of Trade Cooperatives (Saigon Co.op), the growth rate of retail goods and services will fall after the Covid-19 pandemic in 2022, but consumption has increased by 20%, however the structure of commodity consumption is gradually changing towards a focus on essential goods. There is a shift in distribution channels from modern to traditional, the market share of modern retail has fallen from 24% during the Covid-19 epidemic to 18% in 2022.

Mr Duc added that consumer trends had changed. Consumers pay more attention to essential goods that are produced with high standards towards “green”. Therefore, Vietnamese companies cannot ignore this trend.

Ralf Matthaes said that online shopping will decline in 2023 compared to 2022 because life has almost returned to normal after the Covid-19 outbreak.

However, the main trend in 2023 is still online shopping and the supermarket channel is still the most common shopping destination. Street vendors and large shopping malls will continue to struggle

People will cut back on home renovations, car purchases, insurance, expensive electronics, and stock investments.

Mr. Ralf Matthaes predicted the growth rate for 2023 for 5 main types of retail, namely online shopping with a growth of 19%, supermarkets with a growth of 13%, convenience stores with a growth of 7%, fresh markets, residential with a growth of 6% and small shops with 5%. In particular, street vendors and malls fell by 35% and 4%, respectively, compared to 2022.

2023 also shows that consumer confidence is returning but spending will fall by 6% compared to 2022. People intend to borrow more, but mainly to pay off old debts and basic needs.

The cost of education, food, health care and utilities increased mainly due to rising inflation.

Consumer demand is focused on essential items, non-essential items are severely cut.

[ad_2]

Source link