[ad_1]

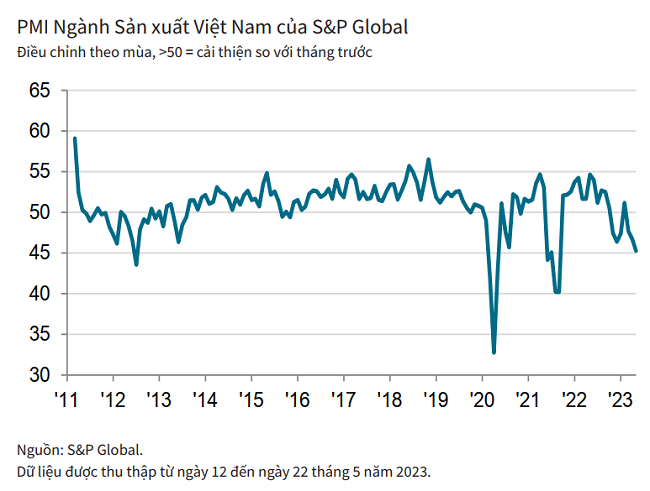

On the morning of June 1, 2023, S&P Global released the Purchasing Managers’ Index (PMI) of Vietnam’s manufacturing industry for May 2023.

There are three highlights: the volume and number of new orders are falling more sharply; Input costs fell for the first time in three years; Employment and shopping activity declined.

Data for May 2023 showed that Vietnam’s manufacturing sector continued to decline as demand remained weak. Production and new orders fell more sharply as companies reduced their employment and purchasing activities respectively. Meanwhile, the business climate continued to deteriorate.

There are still signs of price pressures in the manufacturing sector. Input costs fell for the first time in three years, meaning producers were able to lower selling prices to stimulate demand.

Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) fell to 45.3 in May from 46.7 in April, signaling the third straight month of market value declines. Additionally, this decline in manufacturing health is the most significant since September 2021.

In the most recent survey, there were multiple reports of weak customer demand. The impact is being felt most in new orders as the index quickly fell to its sharpest decline in 20 months. Difficulties in maintaining revenue were also seen in the export markets as new overseas orders fell for the third straight month.

As new orders continued to fall, companies also reduced production in the middle of the second quarter. Production fell for the third straight month and the rate of decline was significant and the fastest since January. Output fell in all three manufacturing sectors, with the sharpest decline in manufacturing. intermediate.

The weakness in demand continues to weigh on business confidence as the index fell for a third straight month to its weakest level since November 2022, the S&P Global report said. Remaining optimism is often based on hopes that the manufacturing recovery will materialize in the coming months.

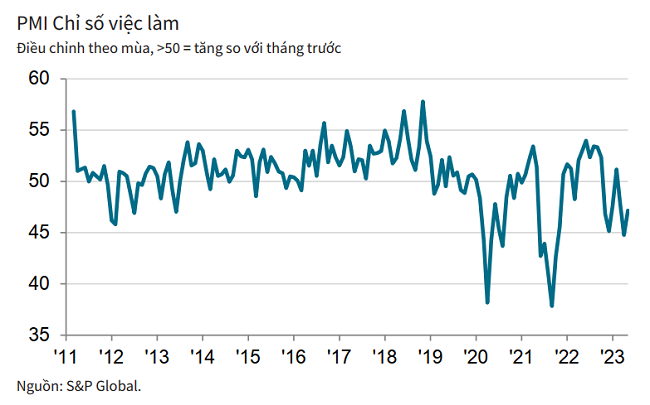

Some companies are reducing the number of employees due to the lighter workload. This, combined with a series of voluntary redundancies, led to a further fall in employment in May, although the magnitude of the fall was less than in the previous survey.

Although companies have reduced their operating capacities, they were still able to cover most of the backlog in May. The number of unfulfilled jobs fell at the fastest rate since June 2021.

Manufacturers have significantly reduced purchasing activities, thereby extending the current reduction period to three months. Since then, inventory of purchased goods has also declined, and the drop is the largest in nearly two years.

Inventories of finished goods also fell as companies adjusted production to reflect a drop in new orders. This is the first drop in three months.

Demand for intermediate goods continues to decrease, so the supply chain is not under pressure. As a result, merchant performance improved for the fifth consecutive year, the biggest improvement since February 2015.

Weak demand is also causing suppliers to lower prices. As a result, input costs fell for the first time in three years. Falling input prices have made it easier for companies to lower their selling prices to stimulate demand. Selling prices fell for the second month in a row, and the rate of decline was almost the same as in the previous survey period.

Commenting on the survey results, Andrew Harker, chief economist at S&P Global Market Intelligence, said the sharp drop in new orders in May raised concerns that Vietnam’s manufacturing sector could see a prolonged, rather than temporary, slowdown. Businesses have responded accordingly by reducing production, employment and purchasing activity.

“Lower demand for intermediate goods has eased the remaining pressure on the supply chain, resulting in shorter delivery times and lower input costs,” Andrew Harker said, adding that while confidence continued to decline in May, economic news was still falling The companies are hoping for a recovery in the coming months. Therefore, the upcoming data will play an important role in signaling improvement.

[ad_2]

Source link