[ad_1]

On November 1, 2022, S&P Global released the Vietnam Manufacturing Purchasing Managers’ Index (PMI) report for October 2022. There are 3 notable highlights: Lower demand leads to weaker growth in new orders; Output growth, employment and purchases increased slightly; Inflationary pressures remain.

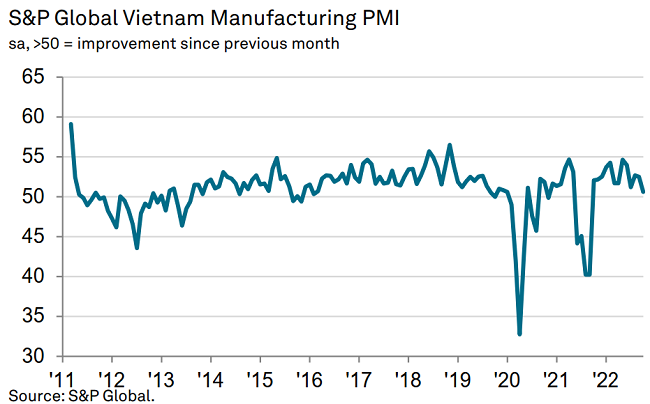

The report noted that while business conditions in Vietnam’s manufacturing sector continued to improve early in the fourth quarter of 2022, there were signs of a slowdown amid weaker new orders growth.

In fact, new business rose for at least more than a year, leading to weaker growth in production, employment and purchases. In the meantime, the cost pressure has subsided, and companies have only slightly increased their sales prices.

The PMI fell to 50.6 points in October 2022 from 52.5 points in September 2022, showing that overall operating conditions for the month were still improving, but this result is the lowest level over the past year.

The main reason for the general slowdown in growth in October was a weaker increase in incoming orders.

Total orders increased only slightly, with the smallest increase since the current uptrend began in October 2021. Rising orders are associated with stronger demand, competitive prices and the acquisition of new customers. However, there are already signs that demand is slowing and exports are also growing at a slower pace.

Manufacturers continued to ramp up production early in the final quarter of the year to accommodate the continued surge in new orders. This shows that the pace of expansion has eased, in line with new business trends and amid signs of slowing demand, to a three-month low. An increase in production can be observed among producers of consumer goods, intermediate goods and capital goods.

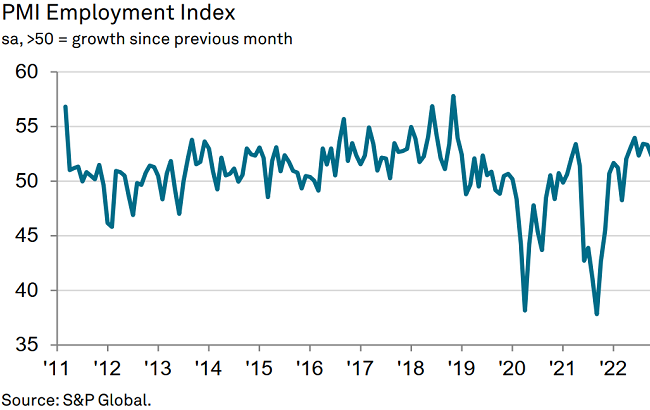

Lower output growth and new orders were reflected in purchase and employment growth in October 2022. Advance purchases rose to a seven-month low, while job creation slowed to the lowest since July.

However, headcount continued to increase throughout the month, contributing to the reduction in backlog as new orders grew more slowly and production capacity was not under pressure.

Stocks of purchased and finished goods declined in October, reversing increases observed in the previous survey period. Indeed, the decline in pre-production inventories was significant during the 16-month period due to slower growth in new orders and purchases, while finished goods inventories typically decline due to the slow pace of production expansion.

Input cost growth was faster but still relatively low and much slower than at the beginning of the year. Respondents attributed the increase in input prices to higher costs for oil, gas, raw materials and transportation. The increase in producer prices also remained unchanged and even fell slightly compared to September.

For the third straight month, supplier delivery times shortened slightly in October, suggesting supply chains are continuing to stabilize after a prolonged period of disruption. Faster growth in intermediate purchases has eased the pressure on suppliers, although there have been some delays due to raw material shortages and transportation difficulties.

Although order intake is expected to improve and the Covid-19 epidemic is no longer expected to disrupt production, helping manufacturers remain optimistic that production will increase next year, confidence for a 13-month Dropped low on some concerns about signs of weakening demand.

Commenting on the survey results, Andrew Harker, chief economist at S&P Global Market Intelligence, stressed that October PMI data shows the first signs of weakness in the global economy are beginning to impact growth at Vietnamese manufacturers, with orders and exports rising to 13- monthly low. Concerns about demand conditions are also affecting business confidence.

However, continued expansion in output and employment combined with reduced supply and price pressures could help Vietnam’s manufacturing sector sustain its growth rate towards the end of the year.

[ad_2]

Source link