[ad_1]

On the morning of July 3, S&P Global released the Purchasing Managers’ Index (PMI) for Vietnam’s manufacturing industry for June 2023.

Among them are three highlights: production and orders declined for the fourth straight month; Selling prices fell at their fastest pace in more than three years and supplier lead times improved to near-record levels.

NEW EXPORT ORDER QUICKLY COMPLETED

S&P Global’s report clearly shows that manufacturers in Vietnam continued to struggle with weak market demand towards the end of the second quarter. Production and orders continued to decline, and the decline in production reflects in part the power shortages caused by the recent heatwave.

The weak demand environment has forced companies to reduce their workforce and purchasing activities, while at the same time prices have fallen. The lack of workload has helped reduce the supplier’s delivery time by the second largest amount ever measured (since March 2011).

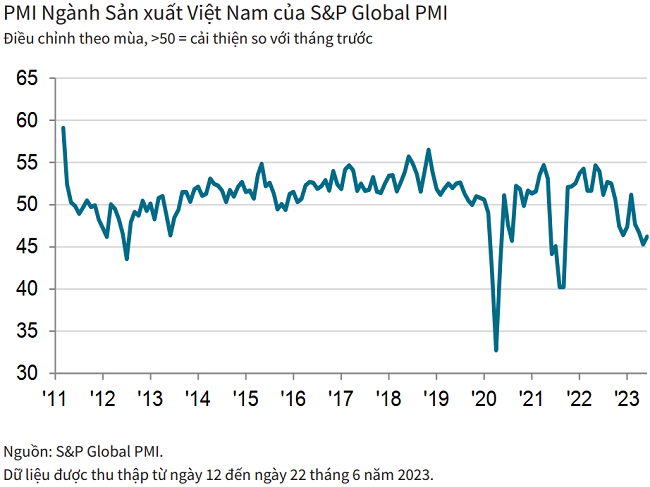

Vietnam’s manufacturing PMI stayed below 50 points for the fourth straight month in June, showing that the health of the manufacturing sector continued to deteriorate. With a reading of 46.2 points versus 45.3 points in May, this index shows that business conditions continue to deteriorate sharply.

Weak demand was frequently cited in the last survey and deteriorating market conditions were the main reason for the fall in new orders. Total new orders fell for the fourth straight month, sharply but still at a slower pace than in May. New export orders fell faster than the total number of new orders as demand in the international market fell.

Weak demand has meant manufacturing output has continued to fall, and there are also reports that power shortages caused by Vietnam’s recent heatwave have slowed growth. Output fell across all consumer, intermediate and capital goods sectors and the overall pace of the decline remained strong.

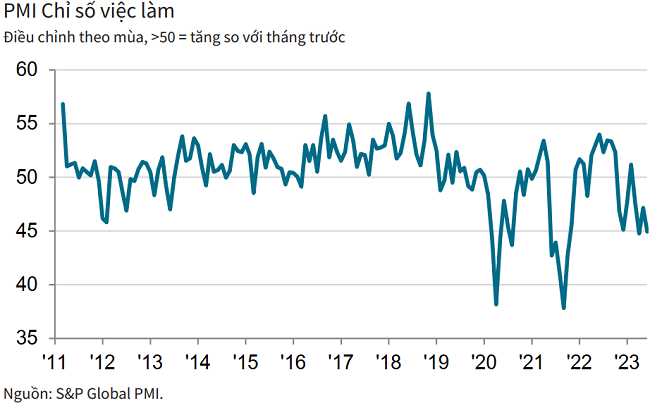

The drop in new orders caused the order backlog to shrink further, while manufacturers responded to the downturn in work with a reduction in employment and purchasing activity.

Employment fell for the fourth straight month, and the rate of decline was significant and stronger than in May.

Shopping activity also fell for the fourth straight month, although the decline at the end of the second quarter was mild. A decrease in wholesale purchases and new orders led to a decrease in purchased inventories. As output growth slowed, finished goods inventories also declined, and this was the second consecutive decline.

CORPORATE CONFIDENCE STILL LOW

The weak demand environment in June also eased pressure on prices, according to a report by S&P Global. In fact, input costs fell for the second month in a row, and the decline was the strongest and fastest. As of April 2020. Lower input prices make it easier for companies to lower their selling prices to stimulate demand. Producer prices fell for the third straight month, the sharpest decline in more than three years.

In addition to the price pressure, the lack of demand in the manufacturing sector also leads to capacity reserves in the supply chain. Supplier delivery times fell the fastest in almost 12 years and were the second-highest since the survey began in March 2011.

Difficulties for businesses are reflected in a series of June survey indicators showing relatively low business confidence, albeit above a six-month low in May. However, manufacturer analysts remain optimistic that production will increase next year, hoping that market demand and the ability to find new customers will recover.

Commenting on the survey results, Mr. Andrew Harker, Chief Economist at S&P Global Market Intelligence, stressed that the S&P Global PMI Vietnam Manufacturing PMI painted a bleak picture of year-end business conditions. Q2, when demand was lacking Main problem faced by companies. As a result, we also see a further decline in production, order intake, employment and inventories. Electricity shortages in Vietnam due to the heatwave have added to the difficulties for businesses.

Meanwhile, prices fell and supplier delivery times shortened to near-record levels in June. While the strong price and supply pressures of recent years need to be mitigated, these trends now largely reflect weakness in demand and could therefore be seen as less positive in recent months.

Overall, the manufacturing sector needs to stimulate demand and as such, global manufacturing developments are being closely monitored for signs of recovery.

[ad_2]

Source link