[ad_1]

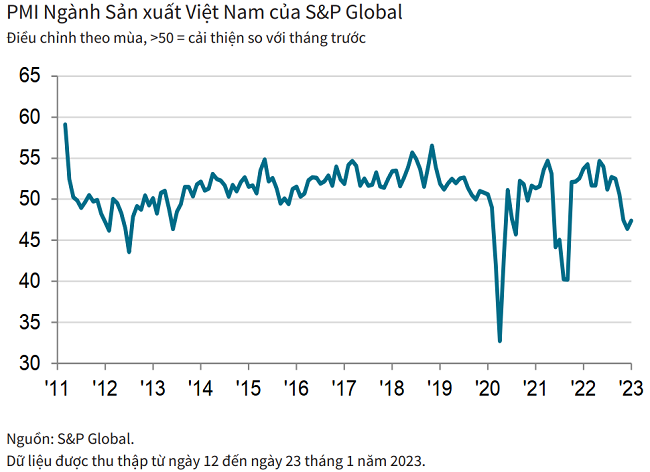

On the morning of February 1, 2023, S&P Global released the Purchasing Managers’ Index (PMI .) report) Vietnam manufacturing industry in January 2023.

There are 3 outstanding highlights: production and number of new orders continued to decline, but at a slower pace; New export orders rose for the first time in three months; Rising expenses hit a six-month high.

NEW EXPORT ORDER NUMBER ORDER ON BACK

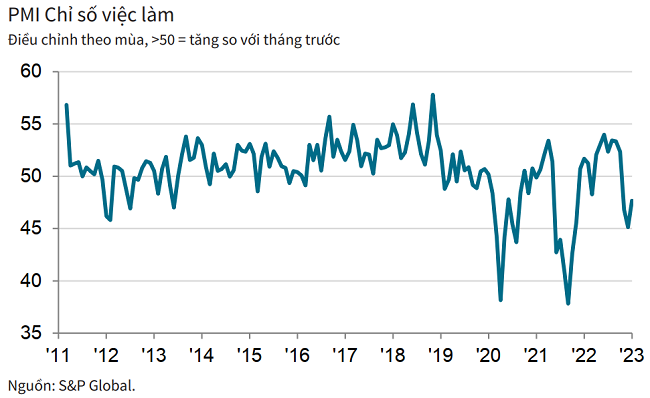

According to the report, Vietnam’s manufacturing industry continued to face difficult business conditions in the first month of 2023. Production and order intake continued to decline. However, there are signs that demand has improved as new orders fall more slowly and new export orders pick up again. Employment also declined more slowly.

The input cost growth rate continued to increase, reaching a six-month high. In view of this situation, manufacturers increased their selling prices for the first time in three months.

January 2023 data shows that production output has continued to decline significantly, although this is a slightly smaller decline compared to December 2022. A drop in new orders is often the cause of a drop in production, with some companies reporting that customers have sufficient inventory and are not making purchases at this time.

Total new orders fell for the third straight month in January 2023 as customer demand remained weak. However, there are signs of improvement as new export orders rose for the first time in three months. As a result, the total number of new orders fell slightly and was the smallest decline in the current decline.

Like some other indicators of the survey period, employment fell slightly in the first month of the year. Headcount fell for the third straight month as production demands eased. Meanwhile, backlogs fell in January 2023 after rising in December 2022, and inventories of finished goods fell the most since June 2021.

BUSINESS CONFIDENCE IS HIGHLY IMPROVED

According to S&P Global, the growth rate of input costs rose for the fifth straight month in January 2023 and was the fastest increase since July 2022. In places where input prices have risen, survey team members say this is due to increased supplier prices, import costs and taxes is due. Firms that produce consumer and intermediate goods have higher input prices, but firms that produce basic capital goods have lower input prices.

The faster increase in input costs prompted manufacturers to raise their selling prices in the first month of the year after attempting to lower them in the last two months of 2022. Selling prices increased slightly and the rate of increase was the fastest in six months.

Raw material costs, coupled with a reduced workload, prompted some companies to further scale back purchasing activities in January 2023. However, some signs of improving customer demand have encouraged other manufacturers to increase their inputs, leaving purchasing activity largely unchanged. However, the decline in intermediate consumption in the previous months has reduced the inventory of purchased goods.

Supplier delivery times have been slightly reduced after having been extended in the previous two months. The reduced demand for upstream services has helped suppliers shorten delivery times. Business confidence improved to a three-month high on hopes of stronger demand for the year, which in turn boosted production. The easing of pandemic-related restrictions in China is another factor supporting the upbeat outlook. More than half of the survey participants are optimistic that production will increase in the next 12 months.

Commenting on the survey results, Mr Andrew Harker, chief economist at S&P Global Market Intelligence, said that although demand for goods from manufacturing companies in Vietnam was still weak in early 2023, new orders and employment continued to fall, there were some positives Signs from this PMI survey. One of the main positive aspects of January 2023 was the increase in the number of new export orders, which in turn slowed down the decline in the total number of new orders.

The easing of Covid-19-related restrictions in China, along with signs that recessions in Europe and the US may be less severe than expected, have fueled optimism about Vietnam’s growth. In fact, the business climate improved to a three-month high at the beginning of the year. S&P Global Market Intelligence forecasts industrial production growth of 6.6% in 2023.

The Vietnam Manufacturing PMI was collected by S&P Global from responses to questions sent to purchasing managers at a panel of approximately 400 manufacturers. The survey groups are divided by sector and enterprise size based on contribution to GDP.

The values of the indicators range from 0 to 100, with a result above 50 representing an overall increase from the previous month and below 50 representing an overall decrease.

[ad_2]

Source link