[ad_1]

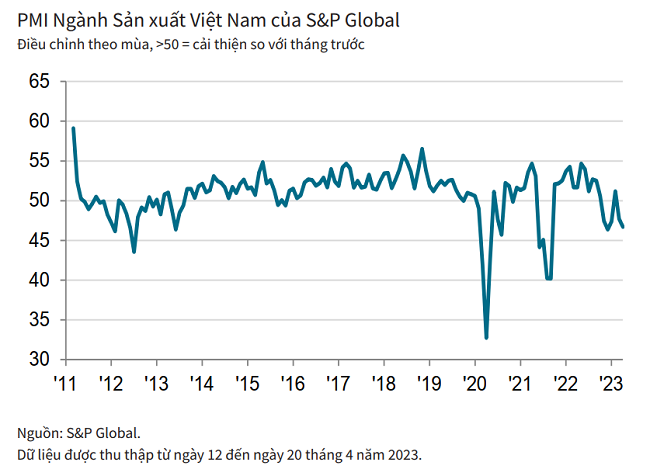

On the morning of May 4, S&P Global released the Vietnam Manufacturing Industry Purchasing Managers’ Index (PMI) report for April 2023.

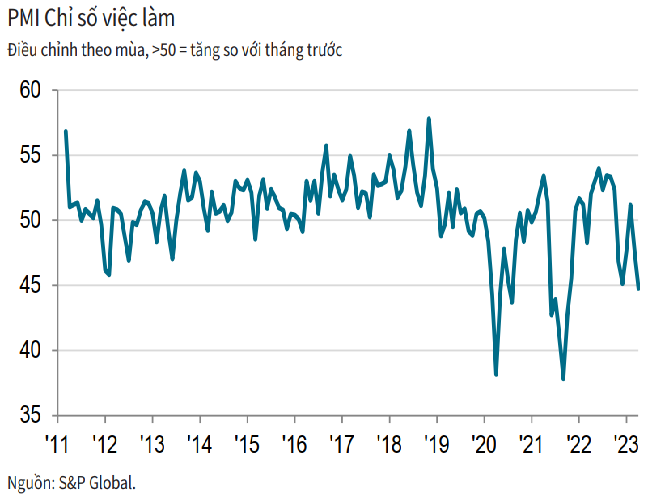

There are 3 highlights, namely the volume and the number of new orders, which fall more sharply; Employment fell for the second straight month; Input cost growth slowed to a 35-month low.

April data showed Vietnam’s manufacturing sector continued to decline as consumer demand remained weak. Both production and new orders fell for the second straight month and firms reduced employment and purchasing activity respectively. Meanwhile, cost pressures continue to ease, which in turn is helping companies lower selling prices to stimulate demand.

The purchasing managers’ index (PMI) of Vietnam’s manufacturing industry stayed below 50 in April, when it fell to 46.7 from 47.7 in March. The decline was the steepest in a year so far.

Output fell for the second straight month and the pace of the decline was sharp as companies said they were struggling to get new orders for the month amid weak demand. The rate of decline is faster than in March.

Difficulty in winning new orders reflected the continued decline in both total orders and new export orders early in the second quarter. The decline in total new orders was faster than in the previous survey, while export orders declined more slowly.

The drop in new orders allowed companies to continue to deal with backlogs that sent the index lower for a fourth straight month. Meanwhile, finished goods inventories rose by the largest amount in two years.

Manufacturers continue to downsize, driven both by layoffs and downsizing due to lighter workloads. In addition, the rate of decline was the sharpest in a year and a half.

Firms also scaled back upfront purchases in April, the second straight decline. Declining demand for upstream services contributed to a reduction in average delivery times for the fourth time in a row. Some companies also report that improved transportation has improved the performance of their vendors.

With the decline in intermediate consumption, the stock of purchased goods fell for the fourth time in a row. However, positive expectations for the future have encouraged some companies to build more inventories, leading to a slight decline overall.

The upbeat sentiment reflects hopes that the current weakness in demand will be temporary and that recovery will occur next year. Despite this, optimism is the lowest it has been for the year so far.

Input cost growth slowed for the second straight month in April, becoming the weakest pace on the current 35-month uptrend as there were some reports that commodity prices had fallen. When input costs increase, companies often attribute the price increase to fuel and oil.

Easing cost pressures combined with weak demand drove producer prices lower, ending a three-month price hike. Selling prices fell in all areas of consumer goods, intermediate goods and basic capital goods.

Commenting on the survey results, Mr. Andrew Harker, Chief Economist at S&P Global Market Intelligence, said that Vietnam’s manufacturing industry appears to be going through a period of stagnation as companies face difficulties in their production.

However, companies remain optimistic that production will increase a year from now, although business sentiment has deteriorated as new orders have fallen in recent months. Manufacturers have started lowering their selling prices to stimulate demand, and cost pressures have made it easier for them to lower prices. In fact, input prices rose at their slowest pace in almost three years.

[ad_2]

Source link