[ad_1]

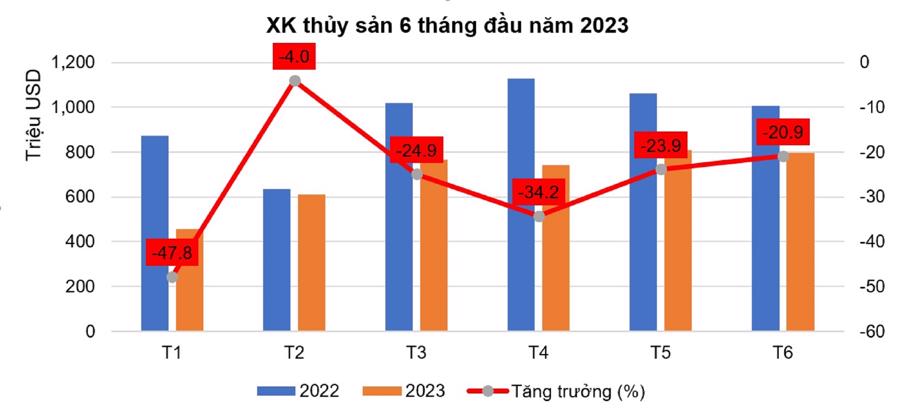

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), seafood exports were valued at nearly US$800 million in June 2023, down 21% from June 2022.

It estimates shrimp exports at $341 million, the highest so far this year but still down 18% compared to June 2022 — also the lowest year-to-date decline. Cumulative shrimp exports reached nearly US$1.6 billion in the first half of the year, down 31% from the first half of 2022.

EXPORT OF SHRIMP, PANGASIUS, TUNA… ALSO DEC

For pangasius industry, exports are estimated at US$156 million in June, still 26% lower than June 2023. Cumulative in the first six months, pangasius export is estimated at over US$885 million, down 38% less than in the same period last year.

Adding to the difficulties stemming from the weak consumer market, shrimp and pangasius producers and exporters have seen profits fall due to high feed, seed and input cost prices. The sale price is low, but it is still difficult to sell, resulting in inventory, which increases the cost…

For the tuna industry, export sales fell by 29% in June 2023, reaching just US$64 million. Cumulative tuna exports reached just US$380 million in the first half, down 31% from the same period last year.

“Supply, demand and inflation swings in many markets have shown no signs of slowing down, hampering the recovery of seafood consumption and import demand in the US and EU… However, the market forecast is not too high for many companies.” As of now By the end of the year, the seafood consumption market is unlikely to recover. If this is the case, he will slowly recover.

Ms. Le Hang, Communications Director of VASEP.

According to Ms. Le Hang, communications director of VASEP, the more negative growth figures in June showed that the export of tuna and other seafood products showed signs of deterioration due to pressures from raw material shortages and increasingly tight control of the import market, typically the EU market, related with food safety control and anti-IUU regulations.

Exports of other marine fish fell more sharply than the previous month, falling 17% to reach just US$157 million, although the previous months saw slight growth compared to the same period last year. Exports of other items such as squid, cuttlefish, crab and shellfish also fell by 17-30% in June 2023 over the same period.

Ms. Le Hang said that the major seafood import markets such as the US, EU, China and Japan are generally influenced by two main factors: inflation and inventories. Inventories are gradually being reduced in the markets, and a renewed increase in demand is expected in the second half of the year. However, inflation has shown no signs of slowing down in many markets, which will be the “brake” preventing the recovery of seafood consumption and import demand in the US and EU…

In addition, Vietnam strongly competes with other producing countries, especially Ecuador and India, in terms of supply and price. While the health and stamina of farmers, fishermen and local businesses is weakened, selling prices fall, production costs rise and consumption falls, inventories rise, capital is depleted and it is difficult to obtain credit to sustain production and export receive.

LOOKING FOR A NEW SOURCE OF CREDIT TO PURCHASE MATERIALS

At the recent shareholders’ meeting of Minh Phu Seafood Corporation, Mr. Le Van Quang, general manager of this company, made the remark: “The seafood export market will be better from August 2023. When the supply of raw shrimp in major exporting countries such as India, Ecuador and Vietnam all fell sharply, global demand gradually recovered. Therefore, units have the opportunity to sell and reduce their inventory when consumer demand picks up during the main festival season at the end of the year.”

“Currently, shrimp farmers in India let about 30-50% of their ponds droop. In addition, Ecuador is affected by El Nino, making shrimp farming inefficient and many shrimp are dying, an estimated 30% loss. In Vietnam, due to the low price of shrimp, many people hang up their ponds, the output drops by 30 – 50%.

Mr. Le Van Quang – General Manager of Minh Phu Seafood Group Joint Stock Company.

According to Mr. Quang, the cost of shrimp production is currently twice that of Ecuador (4.8-5 USD/kg) for three competitors, namely Vietnam, Ecuador and India. USD 2.3-2.4/kg) and 30% more than Indian shrimp (USD 3.4-3.8/kg). This makes it difficult to find orders from shrimp exporters. Meanwhile, the domestic price of raw shrimp has been falling steadily in recent months, which has had many consequences for the whole shrimp industry.

Against the backdrop of declining exports, farmers hanging up ponds, leading to a shortage of seafood raw materials at the end of the year, seafood companies look forward to accessing credit sources to buy raw material reserves for export from now on. in the last 6 months of 2023 and Q1 2024. By implementing the incentives early, shrimp farmers can have peace of mind knowing that they can continue stocking in the current period instead of letting ponds hang.

Commenting on the market situation in the last 6 months of the year, VASEP said that some markets like Japan, Korea, Australia… are still considered optimistic targets for Vietnam’s strong products, which are commodities. Deep processing has high added value. Because in these markets we are not under supply and price competition pressure as in the USA, the EU or China.

In concrete terms, inventories in the markets are gradually being reduced, and demand is likely to rise again in the second half of the year. In addition, some Southeast Asian markets are also identified as having potential due to their more stable economies, lower inflation, geographical advantages and preferential tariffs under trade agreements. Free Trade (FTA).

VASEP forecasts that Vietnam’s seafood exports will gradually recover in the final months of 2023 thanks to more positive signals in consumer markets as stocks fall and the ordering season moves into year-end consumption and big festivals.

[ad_2]

Source link