[ad_1]

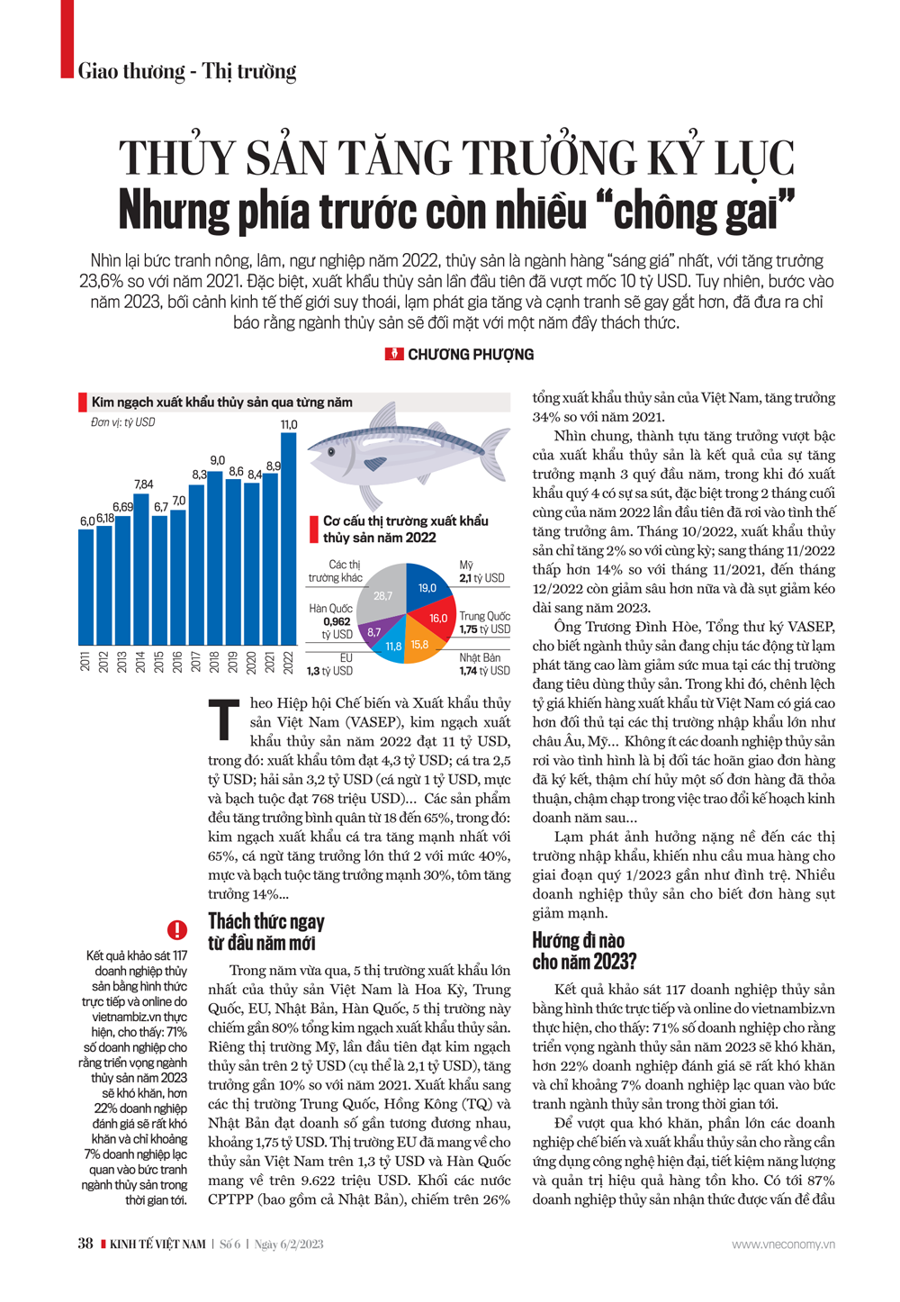

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), seafood export sales will reach US$11 billion in 2022, of which: shrimp exports will reach US$4.3 billion; Pangasius $2.5 billion; Seafood $3.2B (Tuna $1B, Squid & Octopus $768M)… All products grew from 18% to 65% on average, with: Pangasius export sales growing the most at 65%, Tuna with the second largest growth rate at 40%, squid and cuttlefish with strong growth of 30%, shrimp with 14% growth…

CHALLENGES IN THE NEW YEAR

Last year, the top 5 export markets for Vietnamese seafood were the United States, China, the EU, Japan and South Korea. These 5 markets account for almost 80% of the total seafood export turnover.

The US market alone surpassed US$2 billion in seafood sales (particularly US$2.1 billion) for the first time, an increase of nearly 10% compared to 2021. Exports to China and Hong Kong (China) and Japan reached almost the same Sales, about $1.75 billion.

The EU market has brought in over $1.3 billion for Vietnamese seafood and over $9,622 million for South Korea. The block of CPTPP countries (including Japan), which accounts for over 26% of Vietnam’s total seafood exports, grew by 34% compared to 2021.

In October 2022, seafood exports increased by only 2% over the same period; 14% lower in November 2022 than in November 2021, until December 2022 the decrease was even stronger and the decrease dragged on until 2023.

According to the Vietnam Association of Seafood Exporters and Producers.

In general, the outstanding growth in seafood exports is the result of strong growth in the first three quarters of the year, while exports declined in the fourth quarter, especially in the last two months of 2022. first entered a negative growth situation.

Mr. Truong Dinh Hoe, Secretary-General of VASEP, said the seafood industry has been hit by high inflation, which is reducing purchasing power in seafood consuming markets.

Meanwhile, the exchange rate difference makes exports from Vietnam more expensive than competitors in major import markets such as Europe and the US… Many seafood companies face the situation that their partners delay the delivery of signed orders or even cancel some agreed orders, slow exchange of business plans in the next year…

Inflation weighed heavily on the import markets, so that purchase demand for the first quarter of 2023 almost stagnated. Many seafood companies reported a sharp drop in orders.

The results of a survey conducted by vietnambiz.vn among 117 fish companies in both direct and online forms showed the following: 71% of companies think that the prospects for the fish industry in 2023 will be difficult, more than 22% of companies have assessing that prices will be very difficult and only about 7% of companies are optimistic about the picture of the fishing industry in the coming period.

WHAT IS THE DIRECTION FOR 2023?

In order to overcome difficulties, most seafood processing and exporting companies believe that it is necessary to apply modern technology, save energy and manage inventory effectively. Up to 87% of fish companies are aware of the issue of investing in sustainable development technologies, however these companies stated that they could not arrange financing so they cannot use it; Only 13% of companies are ready to invest immediately.

Dr. Ho Quoc Luc, Chairman of the Board of Sao Ta Food Joint Stock Company, recommends that in the near future, fish companies must focus on negotiating with customers to find ways to minimize and share difficulties and damages. Next, companies should review their strengths and weaknesses to find direction for the future.

The content of the article was published in Vietnam Economic Review No. 6-2023, issued on February 6, 2023. Welcome readers to read The:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-king-te-viet-nam

[ad_2]

Source link