[ad_1]

According to the Vietnamese Association of Seafood Exporters and Producers (Vasep), in June 2023 the export value of pangasius to some major markets is gradually narrowing in comparison to the value achieved by the industry in the same period last year. Vietnam’s pangasius exports reached US$143 million in June 2023, down 33% from the same period last year.

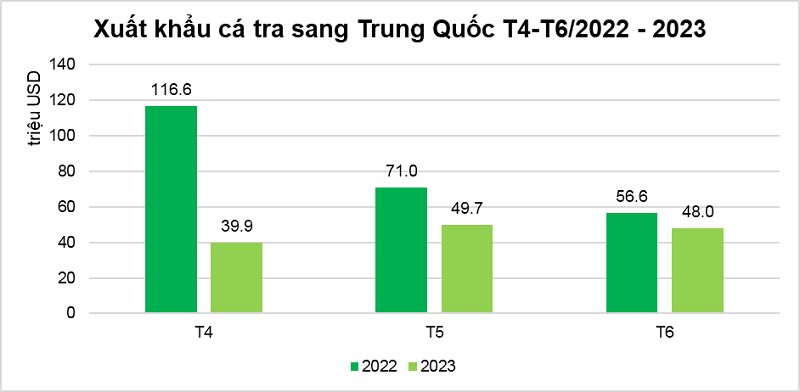

While previously, in April 2023, Vietnamese pangasius export sales to China and Hong Kong fell by 66%, in May 2023 it fell by 30% compared to the same period in 2022, in June this figure decreased to only 15%, reaching US$48 million.

Vasep said that this billion-person country is always among the top 1 markets for the largest consumption of Vietnamese pangasius. This narrowing of the gap can be taken as one of the good signs for the pangasius export industry.

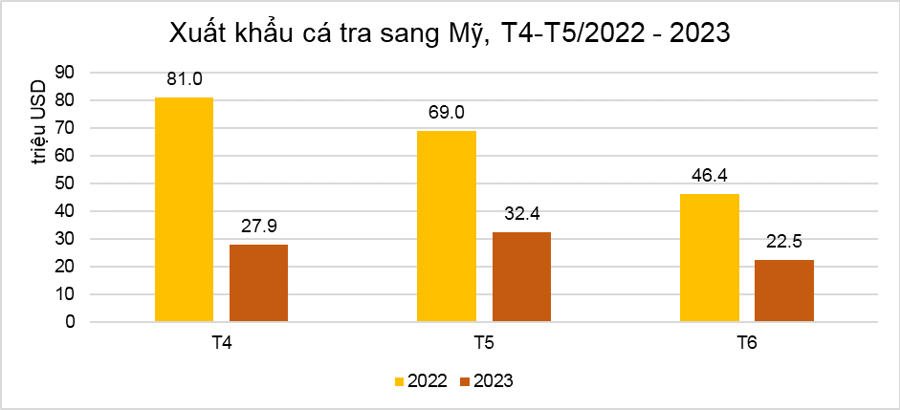

In addition, the export value of Vietnamese pangasius to the United States in June 2023 reached nearly US$23 million, although it still recorded negative double-digit growth in June 2023 compared to the previous two months, the gap has also narrowed. Specifically, pangasius exports to the US fell by 53% in May 2023 and by 66% in April 2023 compared to the same period in 2022.

In general, the average price of Vietnamese pangasius exports to the US market reached US$3.3/kg in the first five months of 2023, down 30% compared to the same period in 2022.

According to VASEP, alongside the inflation factor leading to a drop in demand in the US, the problem of large inventories has also caused Vietnam’s seafood exports to this market to slip into negative growth. The price of the products from the sold-out stock decreased, which caused the price of newly imported goods to become competitive and the price decreased.

In addition, the US Department of Commerce announced that the index of personal consumption expenditure (PCE) increased by 3.8% in May 2023 compared to the same period last year, significantly less than in the previous month (4.3%).

In June 2023, Vietnam’s pangasius exports to markets participating in the Comprehensive and Progressive Trans-Pacific Partnership Agreement (CPTPP) reached US$21 million, down 39% from the same period last year. Markets in the bloc also reduced pangasius imports from 23% to 55%.

The difficult situation is reflected in the business results of pangasius industry “big man” Vinh Hoan, which posted sales of VND846 billion in June, down 20% from the same period last year and down 11% from the previous May. Last month was the sixth consecutive month that this company’s revenue fell by double digits compared to the same period in 2022. In the first six months, cumulative sales of Vinh Hoa reached VND4,921 billion, down 34% compared to H1 2022.

However, according to Vasep’s forecast, the number of pangasius stocks is currently declining in many countries. It is predicted that the demand for import goods will increase sharply for the upcoming holiday and then the export market will prosper.

On the other hand, after a period of holding up, pangasius feed prices are now falling. This creates favorable conditions for farmers to promote stocking in the last months of the year.

Specifically, the feed price fluctuated between VND 12,800 and VND 13,000/kg compared to earlier this year, down from VND 600 to VND 1,000. The price decrease was mainly due to the reduction in aquaculture area.

Currently feed accounts for 50-70% of aquaculture production costs. The agribusiness recommends connecting with food factories, processing plants, banking systems, etc. to access capital with good interest rates, cheap feed and produce consumption.

In addition, many argue that for the pangasius industry to develop effectively and sustainably, numerous mechanisms, policies and disruptive changes from farming to processing to exporting are required.

Looking ahead to the second half of the year, securities firm SSI believes the prospect of orders to the US and China remains uncertain due to slow economic recovery and high inventory levels. However, thanks to lower input prices and transportation costs, pangasius-exporting companies will start to improve their profits.

[ad_2]

Source link