[ad_1]

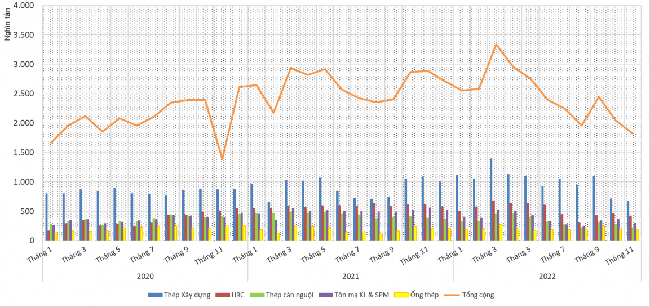

According to a report released by the Vietnam Steel Association (VSA) on December 19, finished steel production reached 1,825 million tons in November 2022, down 10.78% from October 2022 and down 36.8% from the same period in 2021 equivalent species reached 1.942 million tons, up 2.87% month-on-month but down 16.2% over the same period.

In the first 11 months of 2022, finished steel production reached 27.12 million tons, down 11.3% from the same period in 2021. Finished steel sales reached 25.1 million tons, down 6.8% from the same period in 2021.

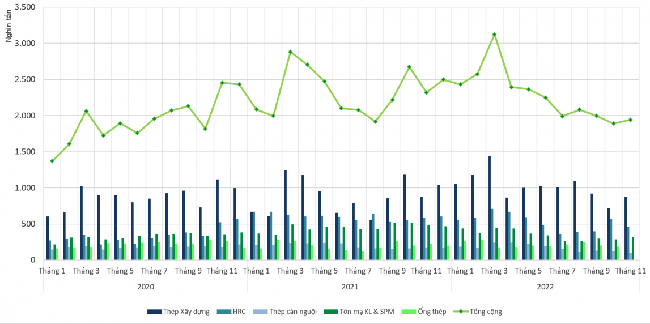

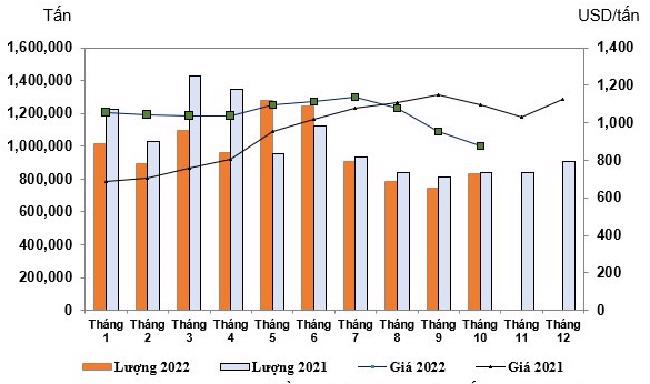

Regarding the export situation, updated data up to October 2022 shows that Vietnam’s finished steel exports reached 531,000 tons, down 0.25% from the previous month and down 57% from the same period in 2021. The export value reached USD 434 million, up 1.17% compared to September 2022, but decreased by 65.66% compared to the same period in 2021.

In the first 10 months of 2022, Vietnam exported around 6.99 million tons of steel, down 36.92% from the same period last year. The export value reached USD 6.945 billion, down 28.92% from the same period in 2021.

The main export markets of Vietnam are: ASEAN region (42.22%), EU region (16.92%), the United States (7.71%), South Korea (5.9%) and Hong Kong (China) (5th .67%).

From the opposite direction, in October 2022, imports of finished steel to Vietnam reached 831 million tons with a turnover of USD 731 million, an increase of 11.8% in volume and 2.86% in value compared to the previous month, but in Compared to the same period last year, the volume fell by 9.15% and the value by 21.43%.

In general, imports of all kinds of finished steel products to Vietnam in the first 10 months of 2022 amount to about 9.76 million tons with a value of more than USD 10.29 billion, down 8.38% in volume , but an increase of 6.87% in value compared to the previous year corresponds to 10 months with the same period in 2021.

The top steel supplier countries for Vietnam include: China (44.11%), Japan (15.65%), Korea (11.11%), Taiwan (9.74%) and India Degree (8.55%).

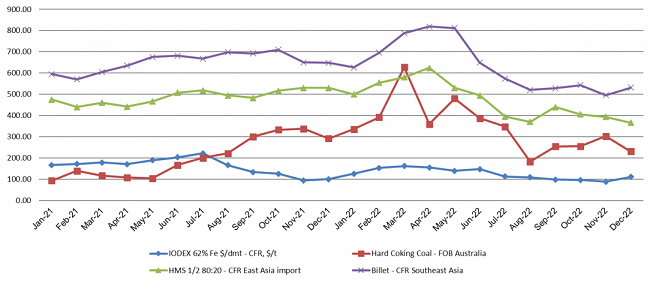

Regarding the market situation of steel making materials, the report by VSA shows that the iron ore price traded at 110.45-110.95 USD/ton CFR Tianjin Port (China) on December 9, 2022, an increase of around 22 $.75/ton compared to early November corresponds to 2022.

The price of coking coal for export in the Australian port traded at around $230.25/tonne FOB on December 9, 2022, a sharp decrease of $71.75/tonne compared to early November 2022.

In November 2022, the domestic steel scrap rose slightly by about VND 200/kg and held the level from VND 8,200 to 9,200/kg. In contrast, the price of imported steel scrap in East Asia port was between 350-366 USD/ton CFR East Asia from late November to early December 2022, down by 28 USD/ton from early November 2022.

Graphite electrode (GE) price update in China, the VSA report said that contrary to the market assessment, the GE price rose in late October and early November.Prices have returned to previous levels due to insufficient demand. Similar price developments were observed on the export markets. Profit margin for UHP600 electrode makers remained broadly stable between $215-$250/ton compared to the previous month. Manufacturers attempted to raise prices in early November 2022 but had to adjust prices at the end of the month. UHP 600 electrodes are currently priced at $3,200/ton.

The price of hot rolled coils (HRC) was 571 USD/ton on December 9, 2022, CFR Dong A Port, increased sharply by 83 USD/ton compared to the trading price at the beginning of November 2022.

In general, the global hot rolled steel (HRC) market fluctuates, which makes the domestic HRC market difficult because flat steel producers (CRC, galvanized steel, steel pipe, etc.) use HRC as raw materials for export.

Commenting on the steel market in November 2022, Vietnam Steel Corporation-JSC (VNSteel) said domestic market demand remained low, consumption was slow, leading factories to adjust production cuts or announced production cuts discontinued due to slow consumption and high stock levels.

According to VNSteel, too, the prospect of a recovery in global steel demand amid high inflation has continued to face difficulties. In addition, the implementation of tightening monetary policies in many countries continues to reduce the prospects for a global economic recovery in December 2022.

The domestic market has not shown clear signs of recovery and the real estate market is facing many difficulties, which will severely affect the consumption of the steel industry. Also, all companies are now looking for ways to restore production and improve profit results in the last month of 2022, which means that the competition between factories is getting fiercer and selling prices are rising.

In the latest Steel Industry Prospect Report, Rong Viet Securities Company (VDSC) also found that the steel industry has little chance of recovering in 2023 due to still weak consumption and exchange rate pressures as well as the rate of profit and financial costs.

In 2023, the government encourages investment in infrastructure projects with the aim of ensuring economic growth that can support domestic steel demand, particularly for structural steel. However, after a quiet 2022, the real estate industry is not expected to recover in 2023, making it difficult to boost domestic steel demand again.

[ad_2]

Source link