[ad_1]

The combination of supply chain disruptions, rising costs and concerns over labor conditions is leading some western fashion brands to reevaluate their decades-long reliance on manufacturer machinery in China, according to the Financial Times.

Dieter Holzer, Marc O’Polo’s former CEO and member of the board of directors, said that from 2021 the Swedish-German fashion brand had started to switch from a number of suppliers in China to factories in Turkey and Portugal. The decision aims to “balance and eliminate risks in the supply chain and make the supply chain more sustainable. I think a lot of companies in the apparel industry are looking at the manufacturing that they have in China,” Holzer explained.

The move away from large-scale textile manufacturing in China, while still in its early stages, marks a reversal of what has happened over the years, as global fashion houses have become too familiar with outsourcing in a country that already has it Textile supply chain occupies a dominant position.

SUPPLY CHAIN AND NEW LABOR LAW

Big names like Mango and Dr. Martens have recently made cuts or signaled they want to shift production out of China or Southeast Asia. “The big message here is to reduce dependence on China. Nobody wants to put all their eggs in one basket,” said Kenny Wilson, CEO of Dr. Martens, last November.

Since Mr. Wilson became the senior executive at Dr. Martens, the shoemaker has shifted 55% of its total production out of China. Just 12% of the brand’s Fall/Winter 2022 collection will be produced in China, up from 27% in 2020, and that share is expected to drop to 5% this year.

“We’re seeing too many signals that apparel manufacturers are looking to pull out of Asia,” said Rosey Hurst, director of business ethics consultancy Impactt.

This shift was also prompted by tougher laws in the US and Europe to protect workers following suspicions of forced labor in Xinjiang, a major cotton-growing region in China.

In December, Mango CEO Toni Ruiz said he was considering reducing purchases from China “but we will be very vigilant about what happens next”. “We’re looking at how global outsourcing, which has been increasing for many years, can become more local,” said Ruiz.

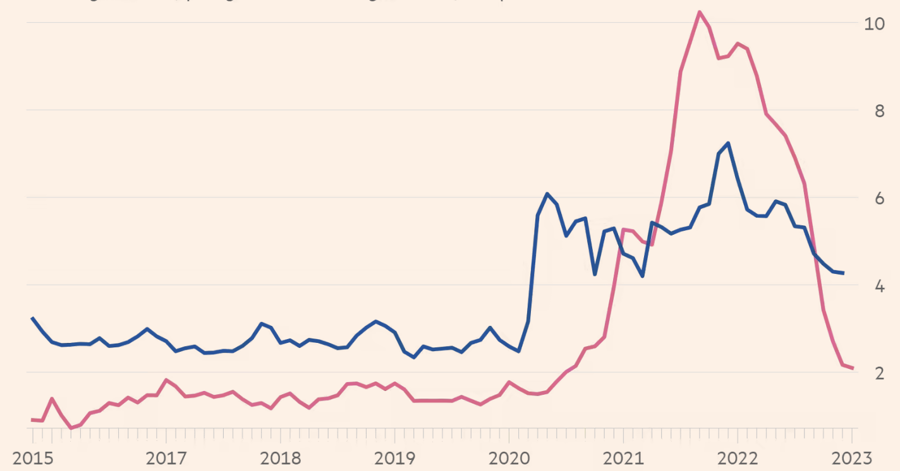

This shift is being driven by supply chain disruptions that have persisted since Covid-19 became a global pandemic, driving up transportation costs. A textile industry adviser said a ski retailer’s order from last season will not arrive until the summer of 2022.

“For many, time is no longer just about manufacturing in China and shipping everywhere,” said Todd Simms, vice president of supply chain intelligence platform FourKites. “The disruption has increased the cost of delivering finished products to customers, resulting in the need to manufacture in other countries for better stability.”

The financial reason to continue manufacturing in China is also shrinking as wages in the country have risen after years of low labor costs – a key factor for many fashion brands coming to this country to set up a factory. Average wages at factories in China have doubled from 46,000 yuan ($6,689) a year to 92,000 yuan between 2013 and 2021, according to data from the General Statistics Office of China.

Asos CEO Jose Calamonte told investors on the full-year 2022 earnings call late last year that Chinese-made products are no longer competitive due to prices in China. These products appear to be on par with those in Europe considering the shipping costs. “We try to think about the ultimate profit margin once the product is sold to the consumer,” he said.

FIERCE COMPETITION WITH SHEIN

European clothing retailers have been working to reduce delivery times as fashion trends and consumer needs change very quickly. This is another reason for the decision to bring production closer together.

“We take control of the production. This is a trend to meet the demands for speed and efficiency,” said a spokesman for a British luxury fashion brand.

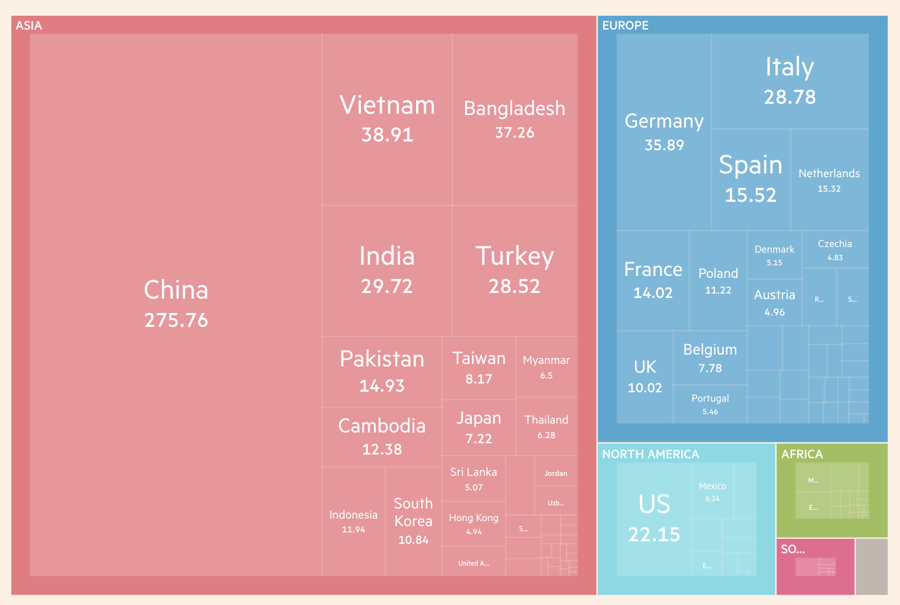

However, plans to move away from textile manufacturing centers in Asia cannot easily be implemented given the complexity of the supply chain. Countries like China and Vietnam account for a large share of global textile and apparel exports, according to CEPII 2020 data. For example, in 2021 more than half of the suppliers of Inditex, the world’s largest fashion retailer, are located in China, only slightly fewer than in 2018.

Turkey has emerged as a beneficiary of Western fashion brands relocating their production, partly because the country is part of a customs union with the European Union (EU) – the manufacturing mechanism for Turkey. “Turkey has become a popular travel destination and is chosen by companies like Hugo Boss, Adidas, Nike, Zara…” said Simon Gaele, executive vice president of supply chain consultancy Proxima.

An increasingly important consideration for retailers is supply chain traceability after years of allegations of worker abuse. “Because of US regulations against Xinjiang cotton, brands need to have much better traceability. Europe is also introducing new laws on forced labor, which puts even more pressure on the fashion industry,” Hurst said.

However, the expert warned: “There is not enough money in international supply chains to move things in the desired direction. Due to the economic crisis, it will be even worse.”

Analyst Maximilian Albrecht of AlixPartners says many fast fashion brands are also moving production out of China to differentiate themselves from Shein, a fast-growing Chinese fast fashion brand. “European brands cannot compete with Shein in terms of production costs, production networks and relationships,” said Albrecht.

“I think there will be some brands that say, ‘I can’t compete (with Shein), so I’m moving production to Europe.’ If the product is made in Europe, you want it to be of higher quality, whether that’s true or not is another question,” Albretch said.

[ad_2]

Source link