[ad_1]

On September 23, the Ministry of Finance issued Official Letter No. 9691/BTC-CST to Ministries and Branches, requesting comments on the draft resolution of the National Assembly on reducing the consumption tax on gasoline and increasing the rate of value-added tax (VAT ) for gasoline. The reason is given Achievement of the socio-economic development goals in 2022 and control of inflation in the last months of 2022 and early 2023.

Option 1: MAXIMUM DISCOUNT 50% SPECIAL EXCISE TAX AND 20% GASOLINE VAT

Currently, the gasoline pollution control tax has been reduced to the minimum level in the tax bracket, while the gasoline preferential import tax has been reduced from 20% to 10%.

However, in order to successfully achieve the set goals, the Treasury has submitted to the government to propose to the National Assembly to give the Standing Committee of the National Assembly powers to adjust and reduce the excise tax on gasoline and the VAT on gasoline.

Specifically, the draft resolution states: “Up to a 50% reduction in the excise duty rate on petrol (including E5, E10 petrol) and a maximum 50% reduction in the VAT rate on petrol of all types and fuels. aviation fuel, diesel oil, kerosene, heating oil, lubricating oil, grease”.

Regarding the concrete reduction in excise duty on gasoline and VAT on gasoline, as well as the timing of applying the concrete tax reduction, the Standing Committee of the National Assembly will be tasked with making decisions in the event that gasoline and oil prices the world continue to have complicated developments, rise or stay up high levels, affecting the inflation index, the macro economy, livelihoods, people’s living standards and economic growth.

Evaluate the implications of the draft resolution toTo ensure synchronization with the VAT reduction in National Assembly Resolution No. 43/2022/QH15 of January 11, 2022 on Fiscal and Monetary Policies in Support of the Socio-Economic Recovery and Development Program, the Treasury has assessed the impact on on the basis of 2 specific options.

option 1, The Treasury proposes a 50% reduction in excise duty on petrol (including E5 and E10 petrol) and a 20% reduction in VAT on petrol.

The application period is 6 months from the effective date of the resolution of the Standing Committee of the National Assembly.

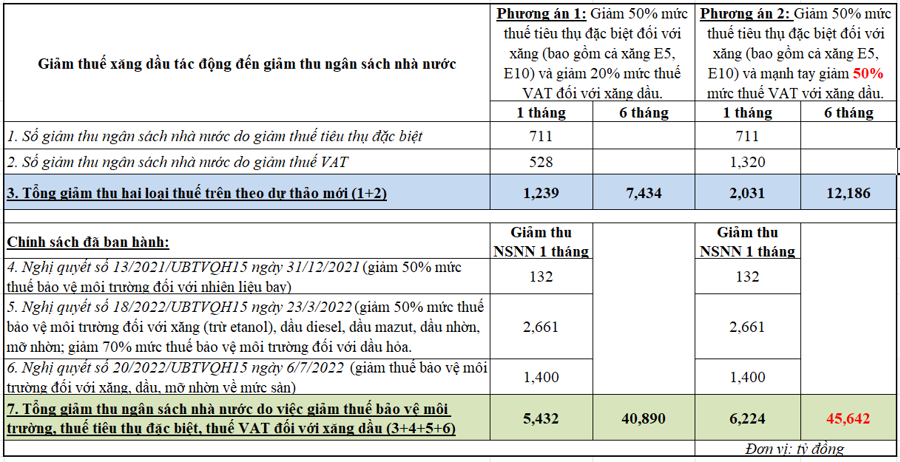

Accordingly, one assumes an expected crude oil price of 100 USD/barrel, said the Ministry of Finance First, tImpact on the state budget, nOn average, the reduction in government revenue is these two taxes each month 1,239 billion VND/month.

If the reduction in environmental protection tax on gasoline, oil and grease is taken into account according to the issued resolutions, the total reduction in state budget revenue per month is about 5,432 billion VND/month.

If the excise duty and VAT reduction time is within 6 months, the total reduction in revenue for these two taxes is 7,434 billion VND.

in the option 1the total cut in state budget revenue due to the proposed cuts in environmental protection tax, consumption tax and value-added tax on gasoline, including the impact of the current decisions, is about VND 40,890 billion.

Monday, Impact assessment on retail prices for petrol, oil, etcWith the above proposal and assuming other factors that make the base price of gasoline and oil unchanged from the operating period on September 12, the tax portion of the base price of gasoline and oil is only about 15.93%, for gasoline E5RON92 about 17.95 %. for petrol RON 95 and about 9.75% for diesel.

Tuesday, Impact on CPI and economic growth, the Treasury acknowledged: “If the effective period of the tax cut measure from November 1, 2022 for consumption tax, VAT. Accordingly, the impact of this tax cut measure is expected to help reduce the average CPI by about 0.1% in 2022.

However, the impact of the tax cut on the CPI depends on the variation in the gasoline retail price in each operating period.

For this “VThe reduction in excise duty and VAT will directly lower the retail price of gasoline and help stabilize domestic gasoline prices. As a result, it will boost production and business activity and contribute to macroeconomic stability and economic recovery in 2022 and 2023,” the Ministry of Finance stressed.

Wednesday, Impact on people and businesses.

The Treasury believes that people are the direct beneficiaries of this policy.

“Reducing the excise tax on gasoline and reducing the VAT on gasoline will help lower the price of goods, thereby directly reducing people’s cost of consuming gasoline and oil, and reducing the indirect cost of other consumer goods,” the Treasury said analyzed.

Both manufacturing industries and companies that use petroleum as an input to manufacturing activities such as transportation, transportation, fishing, gas supply, chemical production, etc. that use petroleum-derived raw materials will benefit more when the directive is issued.

Lowering the excise tax on gasoline and lowering the sales tax on gasoline will help lower production costs and lower product prices, helping companies increase resilience and expand production and business.

Option 2: MAXIMUM 50% reduction in EXCISE TAX AND OIL VAT

plan 2, The Ministry of Finance proposes to reduce the excise duty rate for gasoline (including gasoline E5, E10) by 50% and to drastically reduce the VAT rate for gasoline by 50%. The application period is 6 months from the effective date of the resolution of the Standing Committee of the National Assembly.

The Treasury Department assessed the impact on various companies with an expected crude oil price of $100 a barrel. First, tImpact on the state budget. WOMENOn average, the reduction in government revenue is these two taxes each month 2,031 billion VND/month (where the reduction in budget revenue due to VAT reduction is about VND1,320 billion/month).

If the excise tax and VAT cuts are made within 6 months, the total cut in state budget revenue for these two taxes will be VND12,186 billion.

If the reduction in environmental protection tax on gasoline, oil and grease is taken into account according to the issued resolutions, the total reduction in state budget revenue per month is about 6,224 billion VND/month.

Accordingly, the total reduction in state budget revenue due to the proposed cuts in environmental protection tax, consumption tax and value-added tax on gasoline, including the impact of recent decisions, is approximate 45,642 billion dongs.

It is easy to imagine the impact on state budget revenues due to the reduction in gasoline taxes under the current decision and in the new draft according to the table below.

Monday, In analyzing the impact on retail prices for gasoline and oil, the Treasury Department said that assuming other factors that make up the base price of gasoline and oil remain unchanged from the operating period on September 12, the tax portion of the base price of gasoline is about 13.35%. for petrol E5RON92, about 15.61% for petrol RON95 and about 7.18% for diesel.

TuesdayImpact on CPI, n.aIf the effective date of the tax reduction measure for consumption tax and VAT is from November 1, 2022; Accordingly, the impact of this tax cut measure is expected to reduce the average CPI by around 0.15% in 2022. However, the impact of the tax cut on the CPI depends on the variation in the gasoline retail price in each operating period.

Impact on economic growth, people and businessesSame as option 1 above.

WHAT TYPES OF TAXES ARE REDUCED FOR GASOLINE AND OIL?

Solutions to tax policy for petroleum products will be examined and implemented, the Treasury said one is Regarding the environmental protection tax, the Ministry of Finance has in the past submitted the government to submit Resolution No. 18/2022/UBTVQH15 to the Standing Committee of the National Assembly for adoption effective April 1, 2022 and Resolution No. 20 /2022 /UBTVQH15 reduced the environmental tax rate for gasoline, oil and grease products effective July 11, 2022 through December 31, 2022.

“Currently, the environmental protection tax rate for gasoline, oil and grease products has been lowered to the lower limit in the tax bracket specified in the Environmental Protection Tax Law. The state budget is expected to be reduced due to the tax cut. Environmental protection rate for gasoline, oil and grease is about VND 33,456 billion,” calculated by the Ministry of Finance.

two is Regarding the import tax, the Ministry of Finance submitted Decree No. 51/2022 /ND-CP to the government for promulgation to stabilize the domestic gasoline price as in the past period and diversify the supply of imported gasoline for the domestic market from March 8 August 2022 to change the preferential import tax rate for petrol products in item 27.10 of the preferential import tariff from 20% to 10%.

The Ministry of Finance also provides information on the current excise policy on petrol and VAT on petrol.

Accordingly, in the case of the special consumption tax, according to the provisions of the Law on Special Consumption Tax, only consumption tax is levied on gasoline, and no special consumption tax on oil of any kind.

The excise duty rate for petrol is 10%, for E5 petrol it is 8% and for E10 petrol it is 7%.

The Special Excise Duty Act does not provide for a tax reduction or exemption for excisable goods and services.

In terms of VAT, petroleum products are subject to a 10% VAT rate, similar to many other groups of goods and services.

In terms of jurisdiction, the adjustment of both excise duty and VAT falls within the jurisdiction of the National Assembly, so it must be submitted to the National Assembly for consideration and decision.

According to the proposal of economist Vu Vinh Phu, if you want to solve the problem of gasoline prices at the threshold of VND 20,000-22,000 / liter, so that companies and people can stabilize production, business and services in the long term It is necessary to boldly replace the Oil Price Stabilization Fund to invest through a fund. These are petroleum reserves with reserves of up to millions of tons, which ensure sufficient supply for 3-6 months of use and increase the ability to cope with unpredictable movements in world gasoline prices.

In addition, it is necessary to abolish the excise tax on gasoline in order to contribute to price stability. In addition, the price operation cycle should be shortened from 10 days to 5 days to reduce costs for businesses and avoid losses for consumers. On the other hand, there is a need to redesign the petroleum supply chain, reduce intermediaries, refocus gasoline and oil import and wholesale trade, with a reasonable and stable mechanism for profit-sharing and unit rebates.

[ad_2]

Source link