[ad_1]

Tuna exports have grown steadily in recent years: they reached 651 million US dollars in 2018; reached USD 730 million in 2019; reached USD 648 million in 2020 and USD 733 million in 2021. In the first three quarters of 2022, tuna exports increased by 55% compared to the same period last year, reaching USD 808 million in 9 months.

US MARKET CONSIDERED NEARLY 50%

After months of good growth despite inflation, Vietnam’s tuna exports slowed in October 2022 and November 2022. In particular, the export value of tuna rose only 4% in October compared to the same period in 2021, reaching more than USD 76 million, the second-lowest since the beginning of the year . Tuna exports only reached USD 64 million in November, which is the same as November 2021. In the first 11 months of 2022, tuna export sales reached more than US$948 million, up 41% from the same period in 2021.

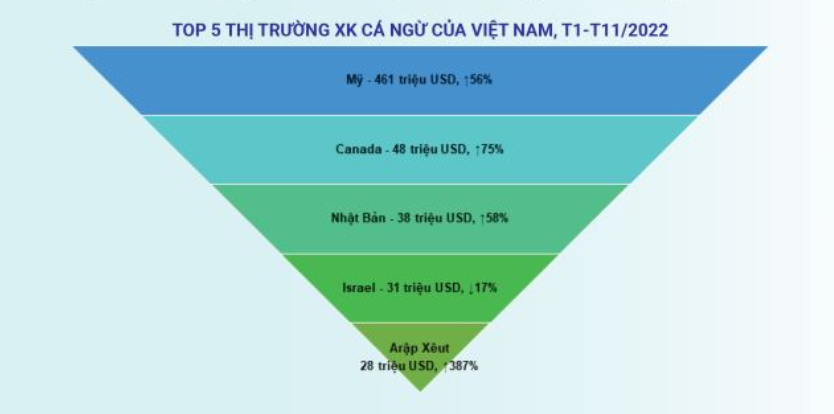

The United States, Canada, Japan, Israel and Saudi Arabia are Vietnam’s top 5 tuna import markets by individual country.

Notably, tuna exports to the US reached US$461 million in 11 months, up 56% from the same period last year. After peaking in April, the value of Vietnamese tuna exports to the United States has been steadily declining month after month so far. Inflation in the United States has eased but remains at a 40-year high. As a result, food prices are still high, dampening the purchasing power of this market in the last months of the year.

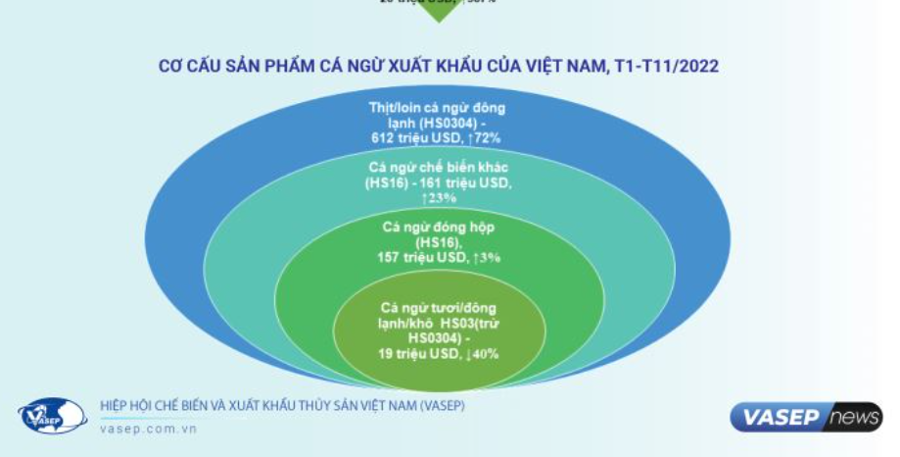

“In terms of tuna product categories, the top tuna product exported is still frozen tuna at $631 million in 11 months, up 72% from the same period last year. Meanwhile, canned tuna were brought home. $157 million, up only 3 The remainder was other processed tuna products with sales of $161 million, up 23% from the same period last year.

According to the Vietnam Association of Seafood Exporters and Producers.

Canada ranked second for the tuna market with $48 million in 11 months, up 75%; third is Japan with $38 million, up 58%; Israel ranked 4th with $31 million, up 17%; The 5th place was taken by the market and Saudi Arabia with a turnover of USD 28 million, up 387% compared to the same period last year.

In particular, tuna exports to Thailand continued to maintain high growth momentum, increasing by 120% compared to the same period in 2021.

According to Vasep, the signals on the tuna market are currently not as positive as they were in the first half of the year. Rising inflation is reducing purchasing power in markets, particularly in markets in the US, Belgium, Israel and Egypt, even in markets that have the benefit of CPTPP tariffs or geographic advantages. Tuna exports to CPTPP countries increased by 95% in 11 months in the same period, reaching US$13.5 million.

EXPORTS TO THE EU GROW STRONGLY IN THE LAST 2 MONTHS OF THE YEAR

While tuna exports to the US and Asian regions surged in the first half of the year and slowed in the fourth quarter; For EU exports, the situation was reversed: difficulties in the first half of the year, accelerated in the last 3 months of the year. The export value to this market block has grown continuously over the last 3 months.

Notably, tuna exports to the EU hit their highest year-to-date in October, reaching nearly USD 19 million, up 22% from October 2021. Tuna exports to the EU reached over USD 20 million in November. In 11 months, tuna exports to the EU market reached more than 150 million USD. Vietnam’s tuna exports to EU markets such as Belgium and Germany tend to increase sharply, by 10-33%.

Looking back to 2022, due to the escalating Russia-Ukraine conflict, Vietnamese tuna processing and exporting companies continue to face challenges such as increased transportation costs, increased production costs (raw tuna price, sunflower oil price, etc.). This has impacted product prices and reduced the competitiveness of tuna companies in export markets such as the EU.

Vietnamese tuna continues to face significant competitive pressures, and regulatory and technical barriers exist and will continue to cause difficulties in the second largest market for Vietnamese tuna imports. Seafood exporting countries will continue to compete more fiercely with some European markets tending to impose stricter regulations and criteria on tuna imported into that market.

“Vietnam’s tuna exports to the EU also have many benefits from tariff preferences as agreed in the Vietnam-EU Free Trade Agreement (EVFTA), which resumed in the first months of 2022. creates a driving force to promote Vietnam’s tuna exports to the market.”

According to the Vietnam Association of Seafood Exporters and Producers.

In addition, despite tax incentives from the EVFTA, the price of Vietnamese tuna is higher than that of imports from other suppliers. At the same time, EU tuna importers always give priority to importing tuna products within the EU, even at higher prices. These are major challenges in the coming period if companies want to increase their tuna market share in the EU market.

At the end of this year, one of the reasons for the growth in tuna exports to the EU is that the markets are preparing for the high season for the end of the year holidays.

In addition, the July 29 EPA-territory Veda ban for 72 days reduced the supply of tuna from that area to the EU market. In addition, the tuna price in Manta, Ecuador is very different from that in Bangkok, Thailand, so the EU currently tends to increase tuna imports from Asian countries.

In this context, Vietnam’s tuna products are more competitive than countries like the Philippines, Indonesia or Thailand with tariff advantages under the EVFTA agreement.

Regarding the tuna market in the first months of 2023, Vasep believes that exporting tuna will be more difficult. Due to high inflation, consumers’ habits are changing and focusing more on cheaper priced products. In addition, the cost of fishing is still high, the IUU yellow card has not been abolished; Fuel costs for fishing… are still obstacles for the tuna industry.

Currently, European Central Bank (ECB) officials are signaling that tough monetary policy has helped the euro appreciate and boosted the purchasing power of Europe’s tuna industry. This has made canned tuna and steamed tuna fillets imported from countries into the EU cheaper. Currently, EU tuna importers are signing orders to be delivered in early 2023 to be exempt from the Autonomous Tariff Quota (ATQ) tax.

[ad_2]

Source link