[ad_1]

On the morning of January 3, 2023, S&P Global released the Purchasing Managers’ Index (PMI) report of Vietnam Manufacturing Industry for December 2022.

There are 3 highlights to emphasize: Work done and incoming orders have fallen sharply; companies reduce employment and purchasing activity; Producer prices fell for the second straight month.

HUGE DISCOUNT NUMBER OF NEW ORDERS

According to the report, Vietnam’s manufacturing industry contracted more sharply in the last month of 2022, when both domestic and external demand fell. Faced with this situation, companies have reduced employment and purchasing activity while business confidence remains low.

There are some signs that cost pressures are returning, but this increase in input prices is still below levels seen throughout the year, allowing companies to price customers down to attract more new orders.

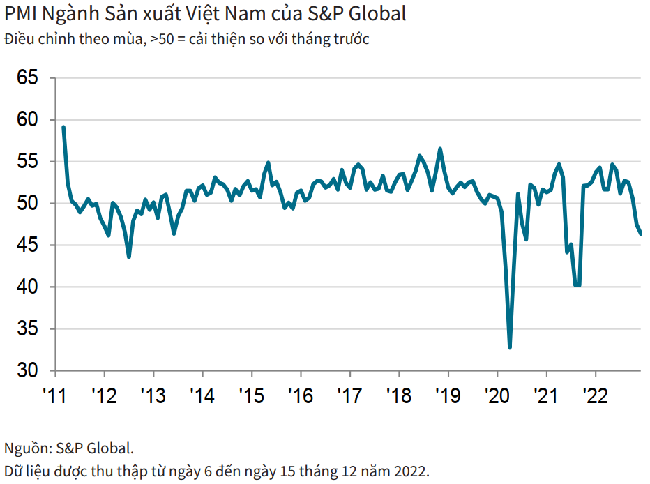

The Vietnam Manufacturing Purchasing Managers’ Index (PMI) fell to 46.4 in December from 47.4 in November, showing the index was below the neutral 50 point reading for the second consecutive day, reflecting the ongoing deterioration in business conditions reflected in the manufacturing industry. The decline over this period is the most significant since the pandemic-driven recession in the third quarter of 2021.

Orders fell sharply in December and this was the second month-on-month fall and the fall was larger than in November, reflecting generally weak demand and the aforementioned weakness in several key export markets. These markets include China, the EU and the US. Weak demand caused new export orders to fall for the second straight month.

Manufacturers cut back production for the second month in a row in the face of declining incoming orders. In addition, the rate of decline is the strongest and most significant since September 2021, and the rate of decline in production is faster than the number of new orders. As a result, the backlog increased, ending a four-month decline.

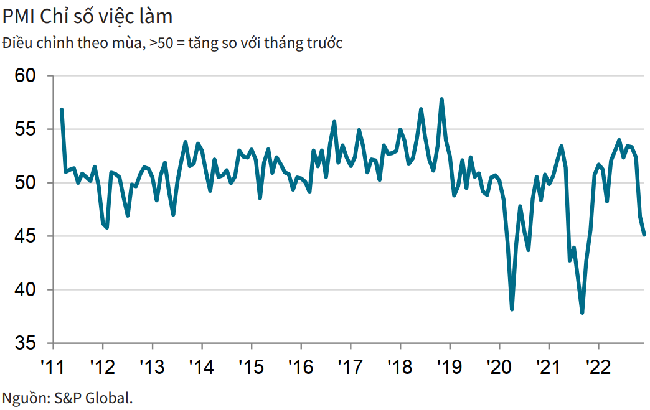

Since the production requirements fell with declining incoming orders, the companies reduced their workforce accordingly. Employment fell at a remarkable rate, and the decline was the steepest in a 14-month period.

Manufacturers also reduced their purchases of inputs, but inventories of purchased goods rose for the first time in three months as production fell to the point where inputs were normally stored and not put into production. Meanwhile, a sharp decline in output contributed to a decline in finished goods inventories.

BUSINESS CONFIDENCE IS IMPROVING BUT STILL LOW

Input costs rose at their fastest pace in five months, according to S&P Global, although the increase is still relatively mild and the rate of increase is much slower than the previous season. Where input prices rose, survey team members cited higher raw material, gas and transportation costs. Meanwhile, the supplier’s delivery time was extended for the second month in a row, but the extent of the extension was only minor.

With costs rising relatively modestly, companies were able to lower their sales prices for the second month in a row in order to stimulate customer demand.

After falling to a 14-month low in November 2022, confidence in the December 2022 annual production outlook remains subdued, albeit with a slight improvement. Some members of the survey team are concerned that difficult market conditions will continue into 2023. Meanwhile, some survey participants expressed optimism that demand will recover, leading to an increase in new orders and production.

Commenting on the survey results, Mr Andrew Harker, chief economist at S&P Global Market Intelligence, said Vietnam’s manufacturing industry continued to face difficulties in December, partly due to lower customer demand in key export markets such as China, the EU and the US . Acquiring new business will remain difficult until these markets recover, and some companies expect demand to remain weak, at least for the foreseeable future.

“Manufacturers have been quick to respond to the fall in new orders as the latest PMI data showed a sharper drop in production, employment and buying activity, and selling prices also fell to boost demand. Industrial production is expected to increase by 6.8% in 2023, a lower rate of increase than in 2022,” stressed Andrew Harker.

The Vietnam Manufacturing PMI was collected by S&P Global from responses to questions sent to purchasing managers at a panel of approximately 400 manufacturers. The survey groups are divided by sector and enterprise size based on contribution to GDP.

The values of the indicators range from 0 to 100, with a result above 50 representing an overall increase from the previous month and below 50 representing an overall decrease.

[ad_2]

Source link